Insight

Inflation is on the rise… how worried should you be?

June 29, 2021

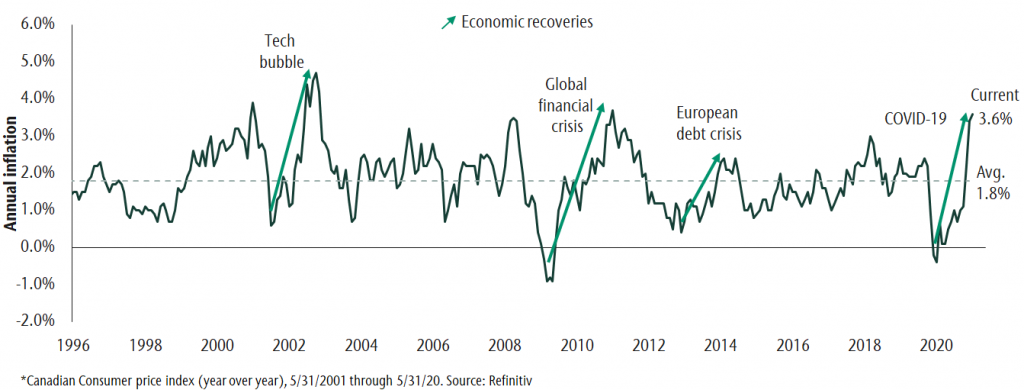

Inflation has moved to its highest level in ten years. Higher prices result from strong economic growth led by pent-up demand for goods and record levels of government spending. At the same time, strong demand is leading to supply shortages. This dynamic is normal and has occurred after every recession. Further, when we look at the components of inflation, we see that recent price increases are largest in industries hurt the most during the pandemic, e.g. energy and travel. These industries are cyclical and are pulling inflation readings higher as prices recover after a period of decline.

We don’t believe investors should be worried about longer-term secular inflation. Higher prices in the short term are expected to be tempered as supply adjusts and demand returns to more normal levels. And while policy actions such as higher spending and larger debt levels have increased short-term inflation, the same forces are deflationary long-term. This is because more money goes to paying down debt as opposed to future investment. The caveat is that higher debt levels encourage policymakers to allow inflation to move higher than it has been in recent cycles. Considering these forces, we believe inflation will be higher but not at the disruptive levels we saw in the 70s and 80s. Our long-term inflation expectation is for a 2.1% increase in prices. This is higher than the last 25 years but still moderate.

Inflation rises during economic recoveries

Impact of inflation on different asset classes.

While we don’t think inflation will be disruptive in the long term, inflation is higher now and likely to be higher during the coming cycle. Now is a good time to consider the effect of inflation on different asset classes that make up your portfolio. Stocks can generally do well in a period of moderate inflation, whereas fixed income is hurt the most. Alternative asset classes also have some natural protection from inflation. Here follows our inflation perspective on each major asset class:

Equities

Moderate inflation is a double-edged sword for stocks. On the one hand it increases corporate cash flows and on the other it decreases the real value of investment returns. Companies with high valuations tend to underperform as their valuations are based on future earnings growth long into the future. In a period of higher inflation, these future earnings are now worth less today. Companies with lower valuations, companies we call value stocks, do better in a period of above-average inflation. Strategically we think it makes sense to hold both growth and value styles within your equity allocation.

In this environment we also want to own companies that can maintain their profit margins and offer specialized goods or services. These companies are more likely to be able to pass on rising business costs to consumers.

Fixed Income

The bond allocation of a portfolio is the one that is hardest hit by inflation. This is because most bond coupon payments do not increase with inflation. In addition, bond yields tend to rise when inflation is moving higher. The result is both a temporary decline in the price of bonds and lower long-term real return.

The negative effects of rising inflation and yields can be managed by holding short-term bonds and higher coupon bonds. The former are less sensitive to changes in inflation and yields. This protects capital when inflation is rising. The latter have more income to offset price declines. Having a view of the economic backdrop and managing a bond portfolio’s sensitivity to changes in yields and inflation is important to delivering risk-adjusted returns. This is particularly true when inflation is on the rise.

Alternatives

The alternative asset classes in a portfolio are attractive since they generate strong levels of income relative to traditional equities and bonds. They also tend to be the least sensitive to risks in the broader economy, including inflation. Each of our private market investments (real estate, infrastructure and private loans) have natural inflation stabilizers. For real estate, rental income tends to rise with inflation and most of our infrastructure contracts have ongoing inflation adjustments. Finally, the coupon payment on private loans are variable and income rises as yields and inflation move higher.

Hedge strategies are a liquid alternative asset class. They don’t directly hedge against inflation, but when allocating to strategy within a portfolio, we reduce bond exposure which is most negatively affected by inflation.

Planning for different investing environments

A well-diversified portfolio by its nature has many offsets to inflation. As active managers we also make investment decisions to improve portfolio returns or mitigate inflation risk. While it’s been a long time since we have had to worry about inflation, we are positioned for higher but moderate price increases. When reviewing your asset allocation, a key point to keep in mind is that inflation does not affect all portfolios equally. More conservative investors with a larger percentage of their portfolio in fixed income are more susceptible to lower returns as inflation rises. As such, it’s important to review the asset allocation on an ongoing basis to see how trends like inflation may impact the ability of a portfolio to meet your objectives. We have many tools to assess the tradeoffs you face as an investor under different market and economic conditions. While the future is uncertain, we can assist you in making informed decisions that consider risks like inflation, among others.

This post is for information only and is not intended as investment advice. The views expressed are those of the author at the time of publication and are subject to change at any time.