Commentaires

No market fairytales here

17 janvier 2024

Summary

- EM underperformed US and international markets through 2023 – posting a 10.3% return in USD terms versus 26.3% for the US, 18.9% for EAFE and 22.7% for Europe ex-UK.

- China was down 11% for the year, while Taiwan was up 31.3%, India 21.3%, Brazil 31.5% and Mexico 41.6%.

- EM equities trade at 11.9x next 12m P/E against a 20-year average of 12.6x, while China trades at 9.3x against a 20-year average of 12.5x.

- Brent crude closed the year at US$80 per barrel, pulling back sharply from its spike above US$90 in October following the outbreak of conflict between Israel and Hamas.

- China held its Central Economic Work Conference in December, with top officials and economic advisers meeting to set growth targets for 2024. Government advisers have told the press that officials are targeting a range between 4.5% and 5.5%, with most favouring around 5% (the same as for 2023). The official target is set to be officially endorsed at the Two Sessions in March.

- As reported in the Financial Times, BYD sold a record 526,000 battery-only EVs to Tesla’s 484,000 during the fourth quarter of 2023. This is the first time BYD has surpassed Tesla in quarterly sales.

“Goldilocks thinking”

Earlier this year, we emphasised our caution with respect to market expectations for the economy and inflation, warning that a Wile E. Coyote moment was a real risk for investors lured into the idea of a “miraculous disinflation” or “no landing” scenario. Bets on the combination of falling inflation, a resilient economy and rate cuts in 2023 were the fuel for a Santa rally propelling tech stocks and cyclicals.

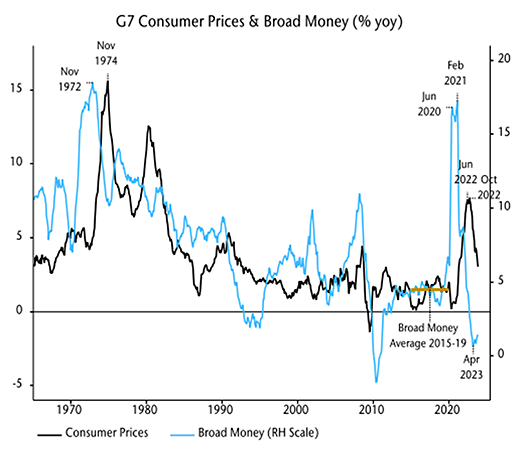

In line with our forecasts, inflation has fallen rapidly as suggested by broad money growth with the usual two-year lag. What has surprised us is the resilience of the US economy despite monetary tightening, which appears partly to reflect consumption driven by savings built up during the pandemic. Improvements in the global supply chain have also supported industrial production.

G7 inflation rates fell by more than most expected during 2023, mirroring a big decline in money growth during 2021 – inflation heading for an undershoot by end 2024

Source: NS Partners & Refinitiv Datastream.

Better inflation news has allowed the Fed to stay on hold since July despite strong Q3 GDP growth and a still-tight labour market. With inflation likely to continue to fall, investors are more hopeful of a soft landing coupled with rate cuts in 2024 and have rerated risk assets accordingly.

Based on the monetary and economic data that we track, our view is that market sentiment is excessively bullish and at risk of a correction. In his latest memo, Easy Money, published on January 9, Oaktree’s Howard Marks struck a similar tone, warning against “Goldilocks thinking”:

“At present, I believe the consensus is as follows:

- Inflation is moving in the right direction and will soon reach the Fed’s target of roughly 2%.

- As a consequence, additional rate increases won’t be necessary.

- As a further consequence, we’ll have a soft landing marked by a minor recession or none at all.

- Thus, the Fed will be able to take rates back down.

- This will be good for the economy and the stock market.

Before going further, I want to note that, to me, these five bullet points smack of “Goldilocks thinking”: the economy won’t be hot enough to raise inflation or cold enough to bring on an economic slowdown.”

We certainly agree. While our analysis suggests that inflation has further to fall and rate cuts should be coming this year, global manufacturing PMI new orders are likely to decline further. Additionally, money trends are yet to suggest a significant subsequent recovery.

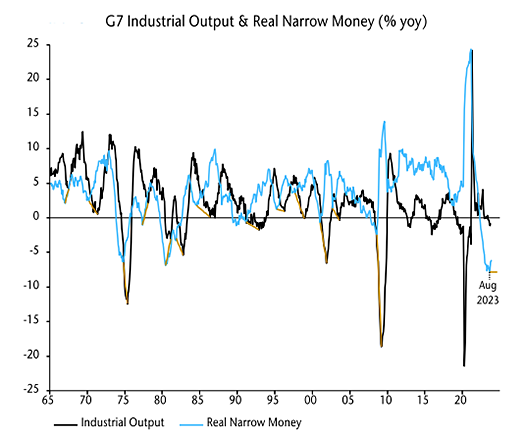

Economic “resilience” partly reflected pandemic catch-up effects, but is consistent with historical experience following monetary tightenings, suggesting greater H1 weakness

Source: NS Partners & Refinitiv Datastream.

G7 annual real narrow money momentum led industrial output momentum by an average 12m at major lows historically, suggesting that the full impact of recent weakness won’t be apparent until mid-2024.

We continue to believe that hard landings are possible in the US / Europe, with resilience to date not inconsistent with historical lags for monetary weakness and yield curve inversion. Against this backdrop, we expect quality and defensive sectors to outperform in the near term on a view that hopes of a soft landing may prove to be premature.

Taiwan’s DPP returned to the presidency but lose the legislature

Taiwan held elections on January 13, with William Lai Ching-te of the Democratic Progressive Party (DPP) winning the presidency, taking 40% of the vote against 33% for Hou Yu-ih of the Kuomintang (KMT) and 26% for Ko Wen-je of the Taiwan People’s Party (TPP).

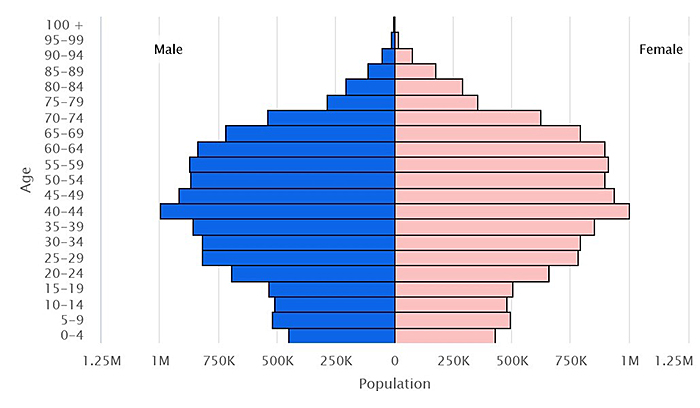

Credibility on management of cross-strait relations to safeguard Taiwan’s democracy was a key issue, and the key factor behind the DDP presidency win. However, voters (particularly younger generations) expressed their dissatisfaction with the DDP on a host of domestic issues that cost the party its hold over the legislature, now controlled by the KMT. Issues include prohibitively expensive property prices, a rapidly ageing population (see chart below), stagnant wage growth and debate over the length and quality of military conscription.

Taiwan faces demographic headwinds

Source: CIA Factbook 2024.

In addition, a host of DPP officials have been caught up in scandals in recent years, including misuse of party funds, academic plagiarism by a legislator subsequently promoted by President Tsai to vice president of the government and an extramarital affair forcing another legislator to step down.

What does China make of it? While China has repeated the rhetoric that “reunification is inevitable”, the election result is unlikely to provoke any material military response from Beijing in the near term, although some PLA muscle-flexing is to be expected in the coming months. Predictably, the Party is claiming the result as a win from its perspective, pointing out that the result signals voter dissatisfaction in the electorate after eight years of DPP rule, with Lai’s win in part owing to Taiwan’s first past-the-post electoral system. The majority of voters went for the KMT (Beijing’s favoured candidate) and political upstart TPP.

Perhaps the most notable development was the rise of the TPP, founded less than five years ago by prominent surgeon and quirky political pragmatist Ko Wen-je. Clever rhetoric and deft use of social media was key for Ko to connect with younger voters, to foreground domestic issues in his campaign over relations with China, effectively counter-positioning with the DPP and KMT.

On China, Ko has shifted over the years from alignment with the DPP towards the KMT, arguing that Taiwan is part of a greater China while disagreeing with Beijing over which state should rule the territory.

Over the next term, Ko and his party have eight seats in the legislature, setting the TPP up as kingmaker to either the KMT with 52 seats or DPP with 51, and a pivotal player on issues such as energy policy, defence expenditure and kickstarting wage growth in the service sector.

Looking further ahead, the TPP may signal the breakdown of old, inherited voting patterns and the emerging base of young voters who identify primarily as Taiwanese but, at least for now, are more focused on domestic economic, social and political issues.