L’argent, le moteur des marchés

A “monetarist” perspective on current equity markets

07 janvier 2026 par Simon Ward

The analytical approach used here is giving mixed messages for 2026 prospects. Global monetary trends appear modestly supportive of economic growth and markets, but the stockbuilding cycle remains on course to enter a downswing this year, with the housing cycle also in a time window for weakness.

Further considerations are likely suppression of labour demand from AI deployment and the unusual magnitude of gains in risk asset prices during the upswing phase of the current stockbuilding cycle.

The judgement here is to give greater weight to cyclical influences and plan for a negative shift in the investment environment during 2026, with caution to be reinforced in the event of deterioration in monetary indicators and / or data confirmation that a stockbuilding downswing is under way.

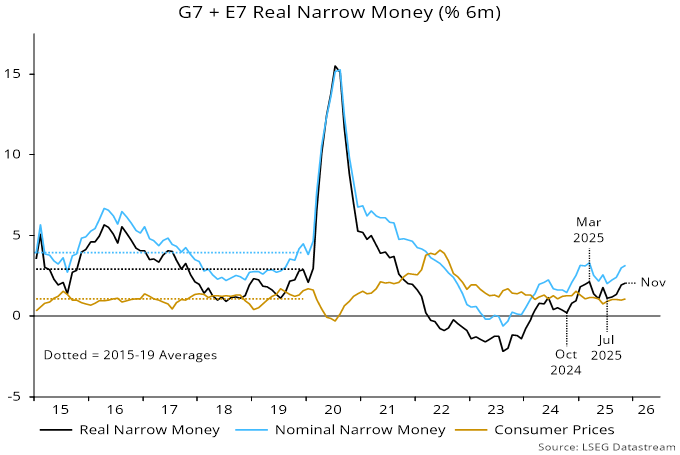

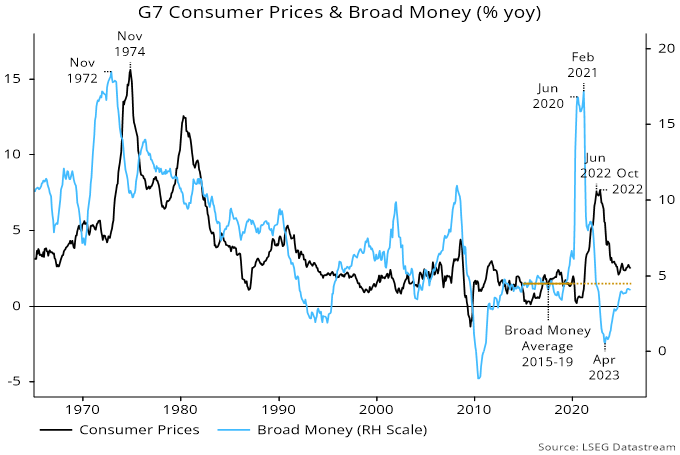

Global six-month real narrow money momentum – the key monetary leading indicator employed here – fell between March and July 2025 but recovered into November. The decline and rebound were driven by nominal money trends, with global CPI momentum stable at around its pre-pandemic pace (vindicating the monetarist forecast of full retracement of the 2021-22 inflation spike) – see chart 1.

Chart 1

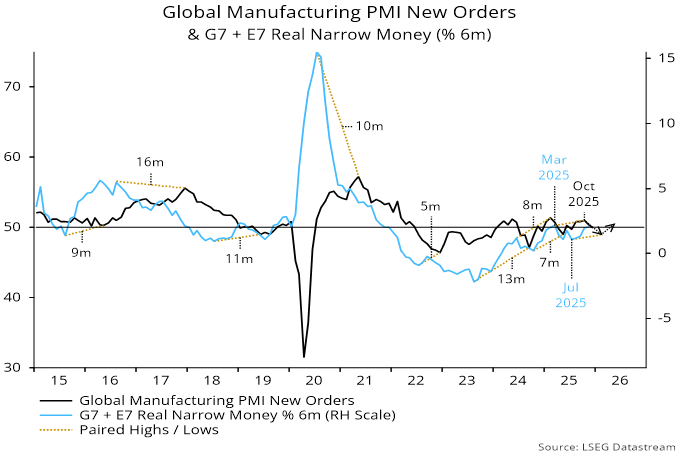

The earlier fall in real money momentum has been reflected in a decline in global manufacturing PMI new orders – a timely indicator of economic momentum – from an October peak. Based on recent lead times, however, the monetary rebound suggests that the PMI will bottom out in early 2026, with a recovery into mid-year – chart 2.

Chart 2

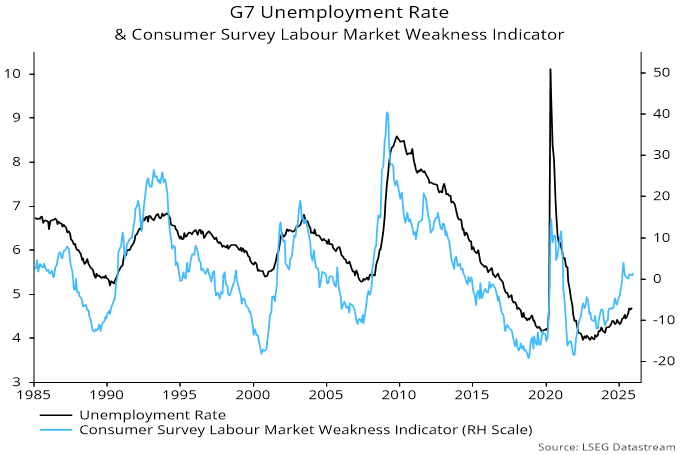

While global growth may hold up in H1, it may not be strong enough to prevent a further rise in unemployment rates, partly reflecting AI job displacement – chart 3.

Chart 3

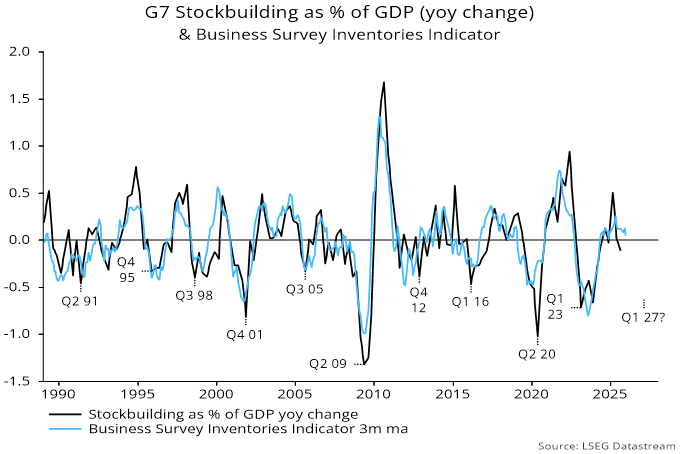

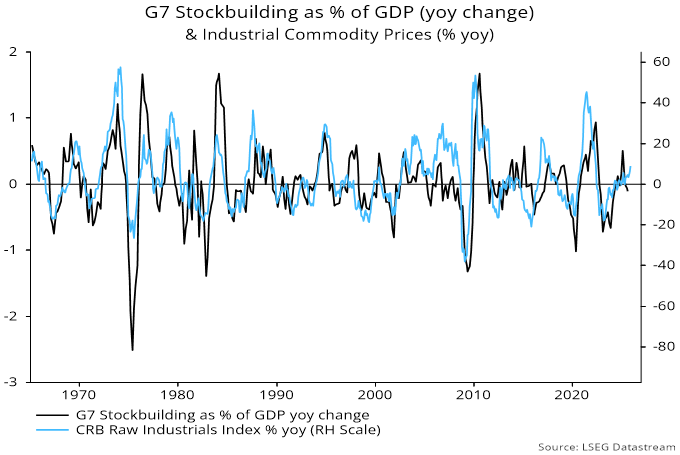

Meanwhile, the stockbuilding cycle – averaging 3.5 years in length historically – remains on course to enter a downswing in 2026, with a possible low in H1 2027. The focus here is on the survey-based indicator shown in chart 4, which has been moving sideways at a level consistent with a cycle peak – a decline into negative territory would confirm a phase shift.

Chart 4

Global inflation is expected to be little changed in 2026, with downside risk judged greater than upside. A key consideration is that G7 annual broad money growth, while recovering further over the past year, remains below its pre-pandemic average – chart 5.

Chart 5

A downside surprise could arise from AI job displacement depressing wage growth. One upside risk is a near-term burst of commodity price strength before the stockbuilding cycle moves into a downswing. Industrial commodity prices rose by less than usual earlier in the upswing and a catch-up could be in progress – chart 6.

Chart 6

The expected transition in the stockbuilding cycle coincides with the housing cycle – averaging 18 years, with a previous trough in 2009 – being in a time window for weakness. G7 housing investment moved sideways between 2023 and H1 2025 but fell to a new low in Q3 – chart 7.

Chart 7

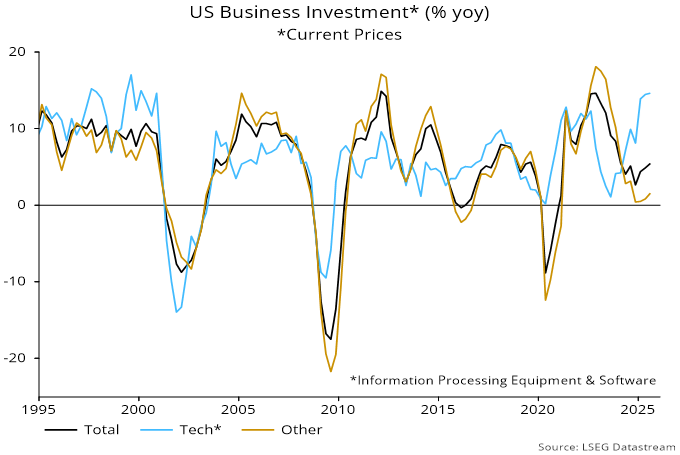

Cyclical hopes rest on further strength in business investment, which follows an average 9-year cycle, with a previous low in 2020. While tech capex is booming, however, it accounts for only one-third of US business investment (and less than 5% of GDP), with other segments weak – chart 8.

Chart 8

The dispersion of real narrow money momentum across countries has narrowed – chart 9. Adjusted for a recent apparent data distortion, US momentum remains slightly below the Eurozone level. Japan is still a negative outlier but the UK has returned to mid-range. Strength in Australia / Canada suggests upside economic and rates risk, with an opposite message from a Swedish move into contraction.

Chart 9

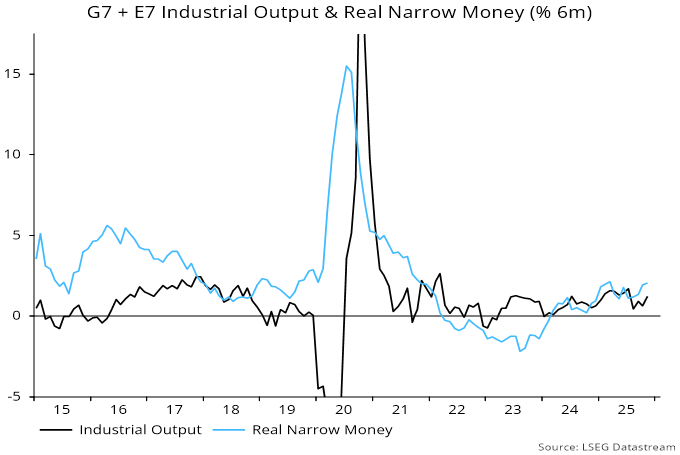

Global real narrow money momentum remains below its long-run average but is nevertheless above weak industrial output momentum, suggesting “excess” money support for markets – chart 10.

Chart 10

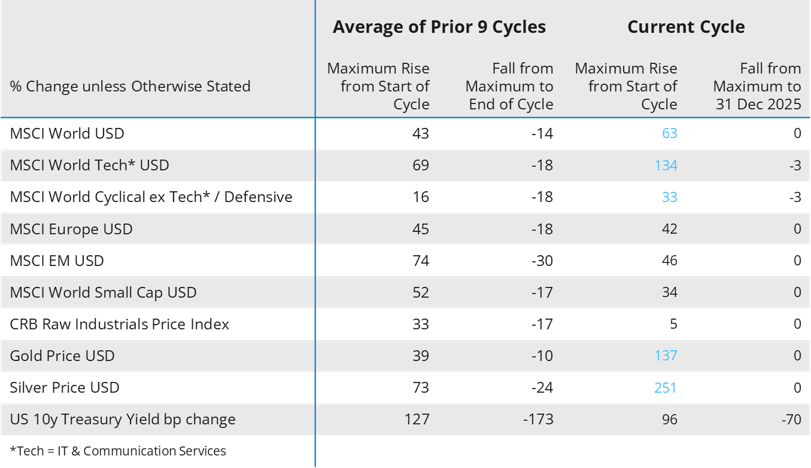

Against this, risk assets have usually corrected – or worse – in the 18 months leading up to stockbuilding cycle troughs, with another such window now open on the analysis here. Table 1 compares moves in selected asset prices in the current cycle with averages across the previous nine cycles, with the mean maximum rise from the beginning of the cycle in column 1 and the subsequent fall into the cycle trough in column 2.

Table 1

Global / US equities, tech and other cyclical sectors, and precious metals have significantly outperformed their average gains in the current cycle, suggesting larger-than-normal reversals into the cycle trough. By contrast, European equities, EM, small caps and industrial commodity prices are lagging their respective averages, so may have more upside potential while a positive environment persists and / or prove more resilient in a subsequent risk-off phase.

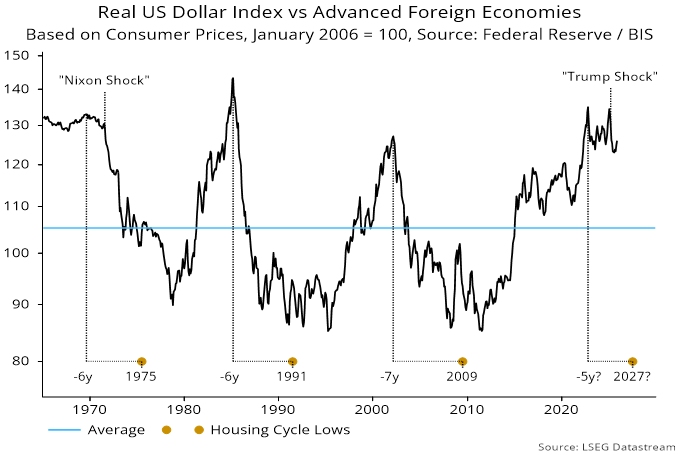

A fall in the US dollar boosted risk appetite in 2025. The timing of the decline echoes the last three housing cycles, in which the dollar trended lower from an overvalued level in the years preceding and beyond the cycle trough – chart 11.

Chart 11

US currency weakness could become market-negative if a decline becomes disorderly, resulting in upward pressure on longer-term rates, for example in the event of further fiscal profligacy or unwarranted additional rate cuts by a politically controlled Fed. Alternatively, a negative market shift could be triggered by a temporary dollar rebound, if US economic news surprises positively and the Fed remains orthodox. Dollar sentiment and positioning were contrarian-bearish at the start of 2025 but current signals are neutral / positive.