L’argent, le moteur des marchés

Cyclical sectors still vulnerable

24 août 2022 par Simon Ward

Cyclical equity market sectors have recouped part of their H1 underperformance of defensive sectors but monetary and cycle considerations suggest further weakness ahead.

MSCI divides the 11 GICS sectors into cyclical and defensive baskets, the former comprising materials, industrials, consumer discretionary, financials, real estate, IT and communication services, and the latter consumer staples, health care, utilities and energy.

The analysis here additionally separates the “tech” sectors of IT and communication services from other cyclical sectors on the grounds that they correlate differently with macro factors. Similarly, energy has distinct characteristics warranting separate consideration from other defensive sectors.

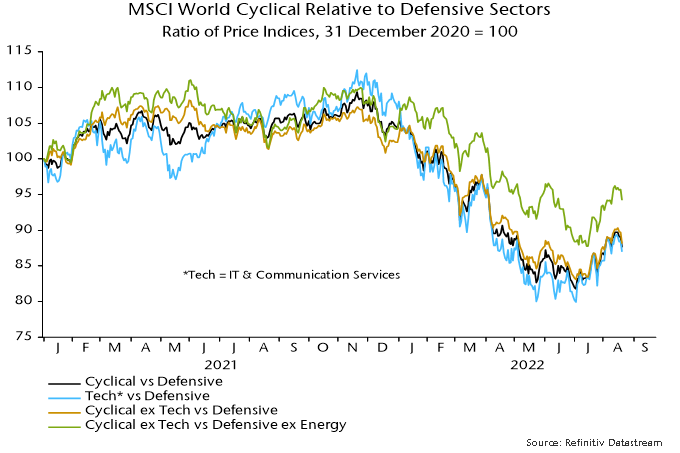

Chart 1 shows various measures of cyclical sector relative price performance, all of which staged significant recoveries from July into late last week.

Chart 1

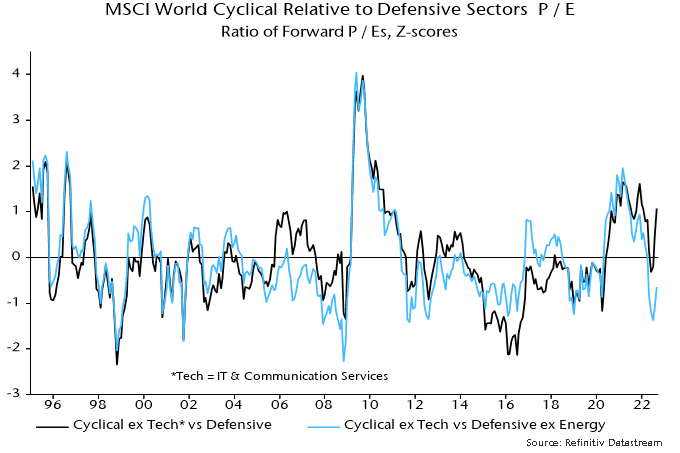

Is there a valuation case for cyclical sectors following their H1 underperformance? Chart 2 shows that the forward P/E of non-tech cyclical sectors relative to the defensive sectors basket is above its long-term average, suggesting overvaluation.

Chart 2

The overshoot, however, reflects current / expected high earnings in energy. Excluding energy from the defensive basket, the P/E relative was 1.4 standard deviations below average at the recent low, although the gap has since halved.

The suggestion that non-tech cyclical sectors offer value, however, depends on current earnings forecasts proving reliable. With the global economy entering recession, downgrades are multiplying and are likely to be larger on average in cyclical sectors. The P/E relative, in other words, could normalise via earnings rather than a cyclical relative price recovery.

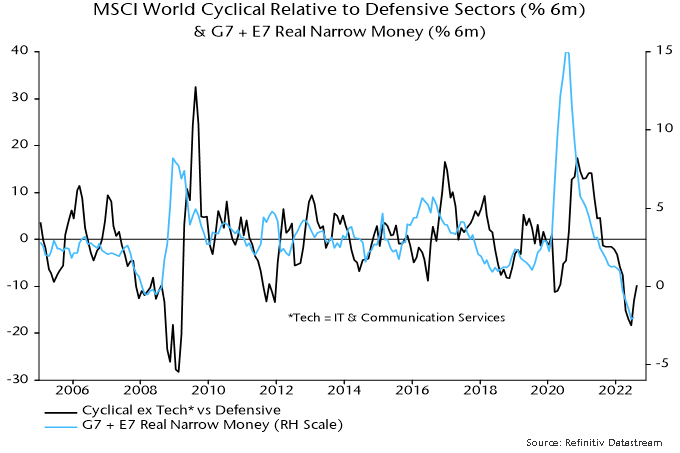

Global monetary trends continue to suggest cyclical weakness. Six-month real narrow money momentum usually moves ahead of major swings in relative price momentum but remains stuck at a multi-decade low – chart 3.

Chart 3

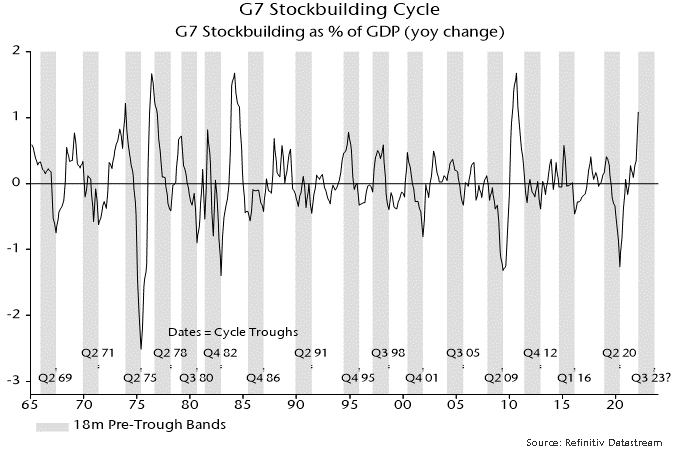

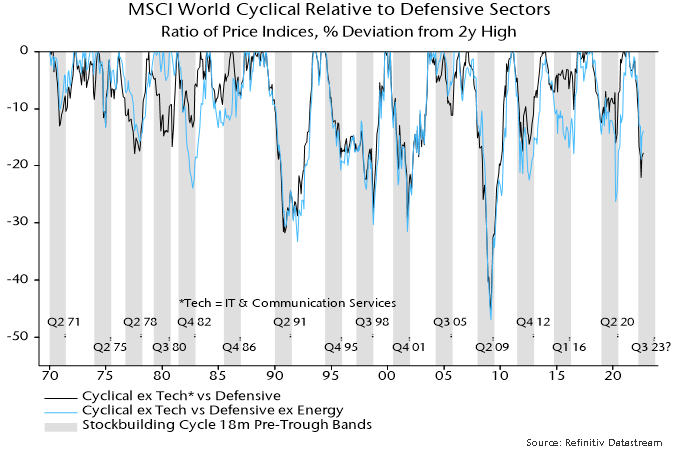

Cyclical relative performance also correlates with the stockbuilding cycle, which, according to the assessment here, is entering a downswing that is unlikely to bottom before mid-2023. Chart 4 shows a long-term history of the cycle, with shaded areas marking 18-month windows preceding prior lows.

Chart 4

Chart 5 reproduces the shading in chart 4, superimposing the drawdown from a rolling two-year high of the non-tech cyclical / defensive sector price relative (including and excluding energy). Historically, the price relative has usually bottomed late in the downswing, or even after the trough.

Chart 5

Cyclical sectors also underperformed sharply at the start of downswings in 2000 and 2011. Minor recoveries ensued followed by a second bout of weakness as the cycle moved towards the trough.

A major relative price low in July so soon after the cycle peak would be unprecedented.