Commentaires

Super-cheap Korean equities rally on market reform talks

15 février 2024

Summary

- A down month in EM equities was led by continued investor pessimism in China, down by over -10% in USD terms. Further commentary below.

- Bucking the trend were securities in India across healthcare, communications, real estate and consumer staples.

- Stocks in Taiwan with AI exposure also outperformed.

Korea adopts Japan’s playbook to boost equities

Bottoming Korean exports growth from October has been led by a recovery in the semiconductor sector, reflected by the outperformance of equities with exposure to the AI supply chain, which posted strong returns through 2023.

South Korea Exports YoY Index

Source: Bloomberg

The market pulled back during the month before bouncing on news that Korean regulators are looking to emulate Japan’s efforts to pressure companies into improving governance and driving higher valuations. These proposed measures look set to boost market laggards trading at below 1x price/book – or around half of the Kospi 200.

While yet to be finalised, terms of the proposal include:

- A requirement that listed companies disclose valuation improvement measures.

- Financial authorities will publish a name-and-shame list of companies that have not announced valuation improvement plans.

Efforts by listed Korean companies to improve payouts, repair balance sheets and buy back shares could see super-cheap stocks lead the market higher. According to CLSA, Korean stocks are under-owned by GEM investors with the Kospi trading at 0.88x P/B as of 18 January.

Strong retail presence

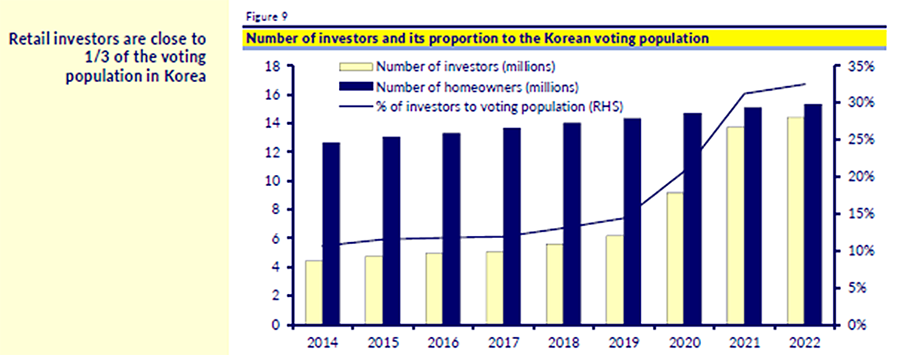

The catalyst for the move is clear. Parliamentary elections loom in April for deeply unpopular president Yoon Suk Yeol, who is looking to improve his prospects by adding further fuel to an export-led economic recovery via the stock market. The move looks savvy given over 30% of the voting age population invests in single stocks in a market that is dirt cheap.

Source: CLSA (Feb 2024)

Our playbook is to stick with our quality names in Korea, across semis giants Samsung and Hynix, autos and financials. Preferred shares for a number of companies also look attractive given massive discounts to ordinary shares. For instance, Samsung preferred shares are trading at a c.20% discount. Pref shares could be bought back at a discount by the parent companies as a cost-effective way to boost shareholder returns.

Economic recovery and reforms to benefit rising automaker KIA

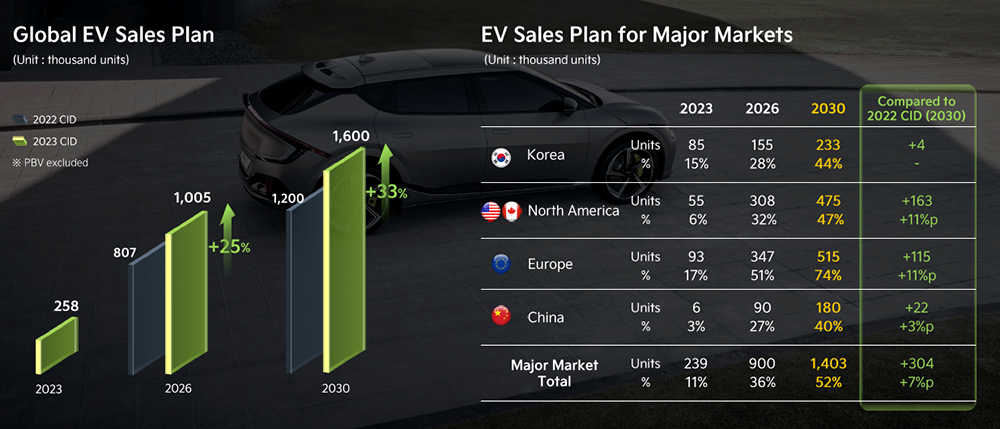

KIA is a brand on the rise, continuing to execute on a premiumisation strategy led by the launch of a series of popular EV models that are on track to reach 40% of sales by 2030.

Source: Kia Investor Presentation, 2022

The stock is trading around 2024E 4.2x PE for a 5.6% dividend yield and return on equity of 18%. This qualifies KIA for laggard status in our view, as it trades below its Japanese peers despite much better returns and margin profile. The company appears to embrace the drive to improve stock performance, having committed to buying and cancelling Won 2.5trn worth of stocks over the next 5 years (6% of outstanding shares).

KIA enjoys strong brand recognition and growing market share in the US and Europe, along with other growing markets such as India. Average selling prices are set to rise as EVs take a greater share of sales, attracting customers on higher incomes (i.e., KIA’s average customer in the US earns over US$150k per annum) who tend to opt for the more expensive trim options. The company has launched a series of premium EVs, which include a number of SUV models (the EV9 is pictured below) that have been especially popular in the US. They boast fast-charging, battery range, performance and looks (KIA’s chief designers hail from the likes of Audi, Lamborghini and VW), rivalling the best EV offerings from premium European brands.

Source: evo.co.uk

Rising vehicle financing costs and recession risks in the US and Europe could slow progress, but recent results have been strong. Declining raw materials costs and the higher SUV mix allowed the company to raise operating profit margin guidance to above the 2023 level (11.9%) and higher-than-market forecasts, putting KIA well ahead of Tesla (9%).

Former general set to clinch presidency in Indonesia

Former Indonesian general Prabowo Subianto is the favourite to win the country’s presidential election in February. The election marks the end of Joko Widodo’s decade in power, stepping down with a remarkable 80% approval rating. Having run against Widodo in the 2014 and 2019 elections, Prabowo now has the backing of the president, along with his 36-year-old son Gibran Rakabuming Raka as a running mate.

The latest polling suggests Prabowo has a chance of winning 50% of the vote needed to avoid a second round run-off. The former military strongman now dubbed the “dancing grandpa” by his young base of supporters has pledged continuity with the policies of Widodo. This includes encouraging investment in industries such as nickel processing to capture more of the battery value chain, along with boosting GDP from the pedestrian 4-5% under Widodo up into the high single digits.

Mexico now the #1 source of imports to the US

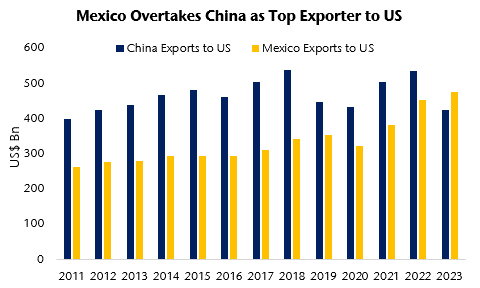

Mexico overtook China as the top source of imports to the US in 2023, fuel for the narrative that “friend-shoring” supply chains will gradually screen China out of the Western trading bloc.

Source: US Census data

The real story isn’t quite so simple – US import data understate Chinese exports, with the total recorded in Chinese data being c.25% higher. This seems to reflect systematic tariff avoidance. In addition, many Chinese firms are investing aggressively in Mexico to take advantage of the North American Free Trade Agreement and gain frictionless access to the US market. As the Wall Street Journal illustrates in a recent piece, China’s exporters can access the US duty-free with Made in Mexico labels:

The participation of Chinese companies in this shift attests to the deepening assumption that the breach dividing the United States and China will be an enduring feature of the next phase of globalization. Yet it also reveals something more fundamental: Whatever the political strains, the commercial forces linking the United States and China are even more powerful.

Chinese companies have no intention of forsaking the American economy, still the largest on earth. Instead, they are setting up operations inside the North American trading bloc as a way to supply Americans with goods, from electronics to clothing to furniture.