L’argent, le moteur des marchés

Japanese money update: still weakening

14 mars 2025 par Simon Ward

Japanese inflation isn’t back and money trends suggest a coming major undershoot.

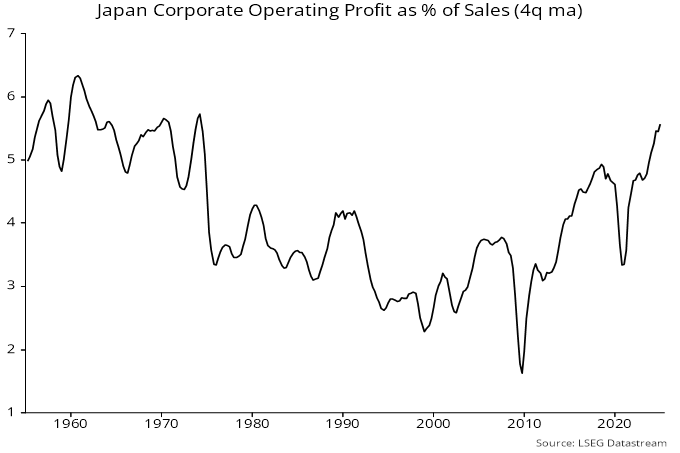

Annual all-items consumer price inflation was 4.0% in January, with Tokyo numbers suggesting a slowdown to 3.6% in February. The current overshoot reflects strength in food and energy prices (which rose by an annual 7.8% and 10.8% respectively in January). Core inflation excluding special effects was 1.6% in January and may have eased to 1.5% in February – see chart 1.

Chart 1

Sub-2% core inflation in early 2025 is consistent with soft money trends two years ago: annual growth of broad money M3 was 2.1% in Q1 2023, below its 2010-19 average of 2.6%, associated with persistent headline / core undershoots.

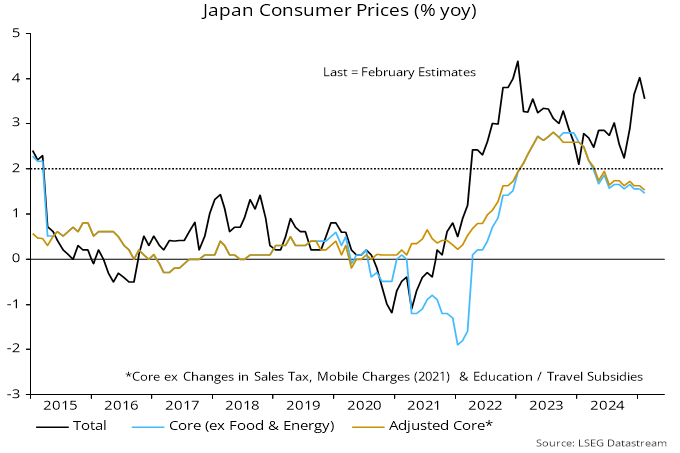

Money trends, however, have weakened much further since early 2023. Annual growth of M3 and M1 fell to 0.6% and 0.8% respectively in February, the lowest since the GFC – chart 2.

Chart 2

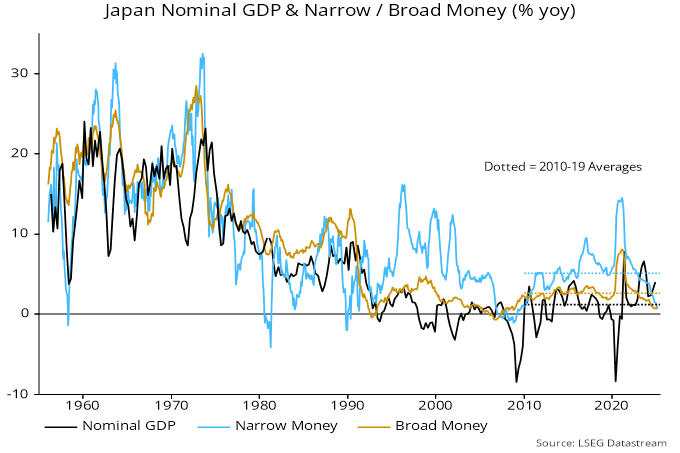

Money growth was depressed last year by record f/x intervention and Bank of Japan QT, reflected in a contraction in banking system net lending to government. The intervention drag has ended but has been replaced by a fall in growth of credit to other sectors – chart 3.

Chart 3

The slowdown in the non-government credit measure in the M3 counterparts contrasts with stable growth of loans and discounts of major, regional and shinkin banks – chart 4. The former series has broader coverage, in particular including lending to financial institutions, which has contributed to recent cooling.

Chart 4

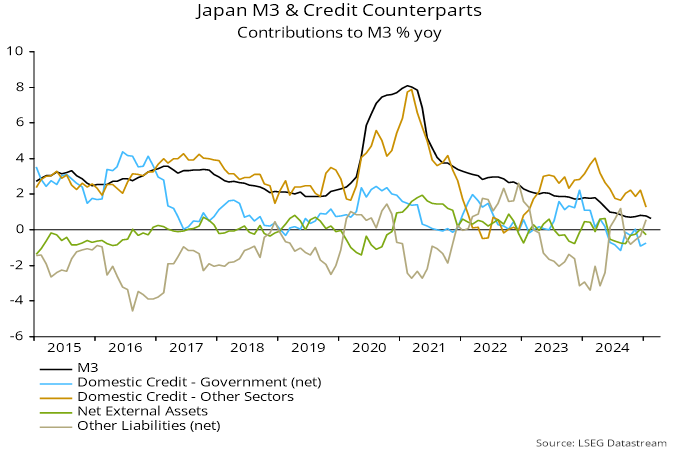

The consensus view that inflation is back rests on strong wage growth. This is being driven by real wage resistance to higher all-items inflation against a backdrop of a tight labour market.

Upward pressure on (real) wages, however, results in sustained inflation only if accommodated by monetary laxity – the opposite of current conditions. With low money growth bearing down on nominal demand, higher wages are likely to squeeze profit margins, which have been overinflated by yen weakness – chart 5.

Chart 5