L’argent, le moteur des marchés

Eurozone money update: sluggish as she goes

28 octobre 2025 par Simon Ward

Eurozone narrow and broad money measures rose respectably on the month in September but six-month momentum remains sluggish, at roughly half the pre-pandemic pace – see chart 1.

Chart 1

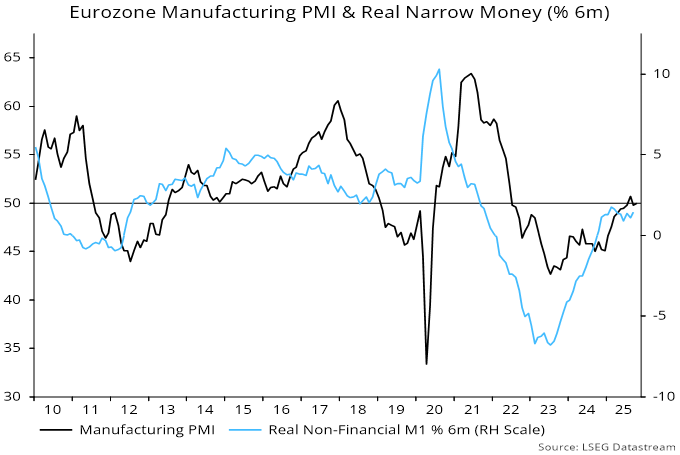

Six-month real narrow money momentum is below a peak reached in February, consistent with a stalled recovery in the manufacturing PMI – chart 2. A recent pick-up in services results may prove short-lived.

Chart 2

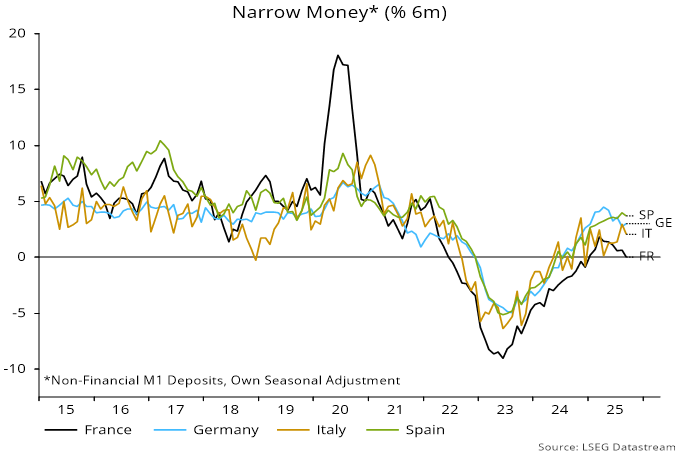

Country details show French relative weakness, with M1 deposits of households and non-financial firms stagnant in nominal terms over the last six months, implying real contraction – chart 3.

Chart 3

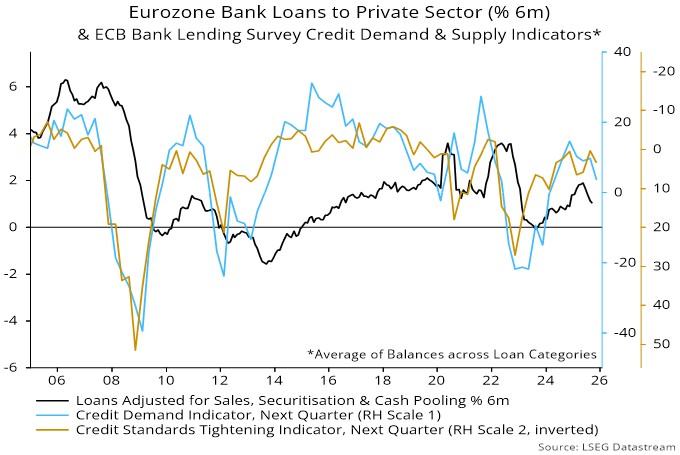

Six-month bank lending growth has cooled, with expected credit demand balances in the latest ECB loan officer survey suggesting a further slowdown – chart 4.

Chart 4

Bullish economic hopes rest on German fiscal easing but restriction elsewhere will temper the impact. The Eurozone cyclically adjusted fiscal deficit is projected by the IMF to widen by a modest 0.3% of GDP in 2026, after no change this year.

A downturn in the stockbuilding cycle could more than offset fiscal support. A rise in stockbuilding accounted for 0.8 pp of GDP growth of 1.5% in the year to Q2 2025. (The “true” contribution will have been smaller because of an associated increase in imports.)

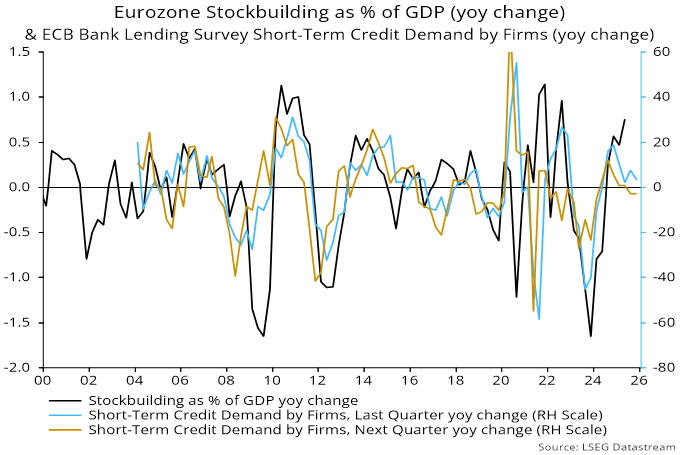

Stockbuilding is a key influence on firms’ demand for short-term credit. Year-on-year changes in credit demand balances in the bank lending survey have weakened, consistent with a prospective stockbuilding downswing – chart 5.

Chart 5