L’argent, le moteur des marchés

Are OBR forecasting swings destabilising UK fiscal policy?

25 novembre 2022 par Simon Ward

The major fiscal tightening announced by Chancellor Hunt in the Autumn Statement was motivated by a markedly more pessimistic OBR assessment of medium-term prospects for the economy and public finances. Even if its latest forecasts prove “correct”, revisions on this scale between six-monthly forecasting rounds are questionable and result in undesirable volatility in policy-making.

The economic outlook has deteriorated since the March Budget but the OBR’s fiscal assessment is based on the projected level of potential output four to five years ahead. This relies on assumptions about trends in productivity and labour supply and should be little affected by the prospect of a near-term recession.

The OBR has revised down its projection for potential output growth over the forecast horizon by a whopping 1.7 pp since March, mainly reflecting an assumed hit to productivity from energy prices staying high over the medium term. An associated loss of receipts accounts for almost a third of the £75 billion upward revision to borrowing in 2026-27 based on unchanged policies.

The OBR ignored the productivity implications of high energy prices in March on the grounds that it was unclear whether they would persist. The outlook is no less uncertain now yet the OBR has chosen to incorporate the full hit. A better approach would be to phase in adjustments over several forecasting rounds, varying the pace depending on energy price developments between rounds.

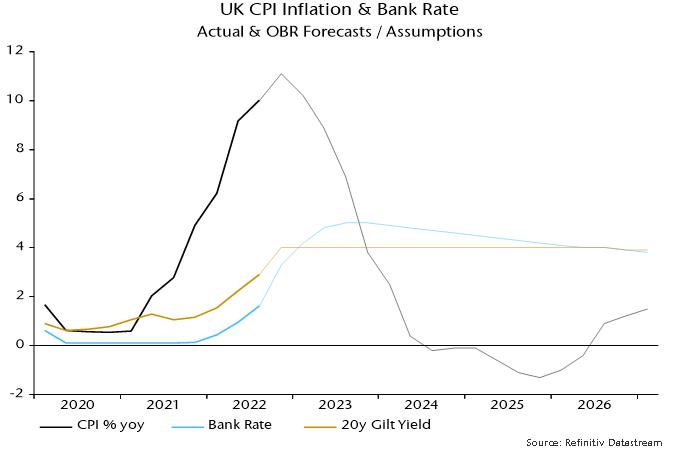

The most significant forecasting change since March was a substantial upward revision to the path of interest rates, with Bank rate and long-term (i.e. 20-year) gilt yields now averaging 4.4% and 4.0% respectively between 2023-24 and 2026-27, versus 1.5% for both previously. An increased debt interest bill accounts for £47 billion of the £75 billion boost to 2026-27 borrowing.

The interest rate assumptions are derived from market rates but they are clearly inconsistent with the OBR’s economic forecasts – particularly its projection that the annual change in consumer prices will turn negative in Q3 2024 and remain below zero for a further seven quarters.

The MPC’s latest forecasts show CPI inflation falling below target two to three years ahead if Bank rate remains at the current 3.0%*. An assumption of a 3.0% average for Bank rate is a more sensible basis for the medium-term fiscal forecast. If long-term gilt yields were also to average 3.0%, the interest bill in 2026-27 would be £21 billion lower than the OBR has projected, according to its debt interest ready reckoner. This is equivalent to three-quarters of the extra tax raised in 2026-27 from measures announced in the Autumn Statement.

A possible interpretation is that Chancellor Hunt has been bounced into unnecessary fiscal retrenchment by a combination of a questionable downgrade to the OBR’s productivity projection and its punctilious adherence to a forecasting convention – of using yield curve-derived interest rate assumptions – that made little sense in the context of recent stressed markets.

Chancellor Hunt, however, may have had an incentive to collude with the OBR’s doom-mongering, since it has allowed him to “kitchen sink” fiscal bad news in the reasonable hope that another OBR forecasting swing will open up space for him to reverse course and announce tax “cuts” before the next general election.

*CPI inflation falls below 2% in Q2 2024 in the MPC’s modal (i.e. central) forecast and in Q3 2025 in its mean forecast (which incorporates a risk bias to the upside).