Money Moves Markets

Do monetary trends explain recent inflation divergence?

February 16, 2024 by Simon Ward

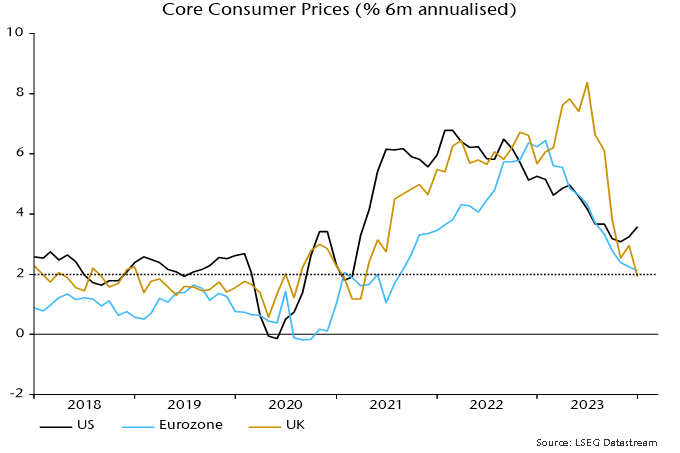

Six-month core CPI momentum has returned to a target-consistent level in the Eurozone and UK, with January readings of 2.1% and 1.9% annualised respectively*. US momentum is significantly higher, at 3.6% – see chart 1. What explains this gap?

Chart 1

One answer is that the US CPI is overstating core pressure. The six-month increase in the Fed’s preferred core PCE measure was 1.9% annualised in December. Assuming a monthly rise of 0.4% in January (the same as for core CPI), six-month momentum would firm to 2.4% – still little different from Eurozone / UK core CPI readings.

The stronger rise in the US CPI than the PCE index reflects a higher weighting of housing rents and a faster measured increase in “supercore” services prices.

Perhaps reality lies somewhere between the two gauges, i.e. the stickiness of US core CPI momentum is at least partly genuine. If so, the US / European divergence may be explicable by monetary trends in 2021-22.

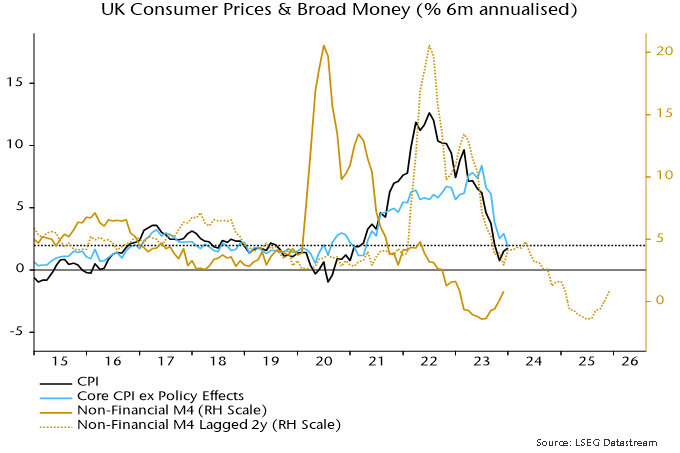

Previous posts highlighted the close correspondence between the slowdowns in Eurozone and UK six-month CPI momentum and profiles of broad money growth two years earlier. Chart 2 updates the UK comparison to incorporate January CPI data.

Chart 2

UK and Eurozone six-month broad money momentum peaked in summer 2020 and had returned to the pre-pandemic range by late 2021. This is consistent with the reversion of six-month headline and core CPI momentum to target-consistent levels around end-2023.

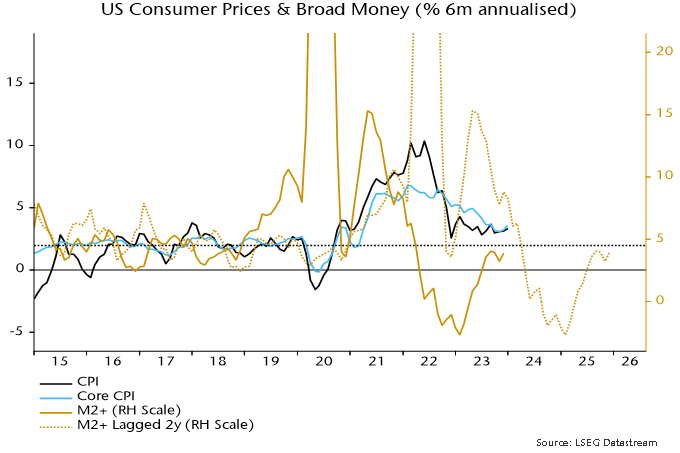

US broad money momentum followed a different path, with a more extreme surge in summer 2020, a return to earth in H2 2020 and a secondary rise in H1 2021, driven partly by disbursement of stimulus checks in December 2020 and March 2021 – chart 3.

Chart 3

The sharp fall in US six-month money growth during H2 2020 was echoed by a slowdown in CPI momentum into end-2022 – much earlier than occurred in the Eurozone and UK. More recent CPI stickiness may reflect the lagged effects of the secondary monetary acceleration into mid-2021.

What does this suggest for absolute and relative prospects? The judgement here is that broad money growth of 4-5% pa is consistent with 2% inflation over the medium term. US six-month money momentum crossed below both this range and UK / Eurozone momentum in May 2022, reaching an eventual low in February 2023, at a weaker level than (later) lows in the UK / Eurozone.

Assuming a two-year lead, this suggests that US six-month core CPI momentum will move down to 2% around mid-2024 on the way to a larger (though possibly shorter) undershoot than in the UK / Eurozone.

*Eurozone = ECB seasonally adjusted CPI excluding energy and food including alcohol and tobacco. UK = own measure additionally excluding education and incorporating estimated effects of VAT changes, seasonally adjusted.