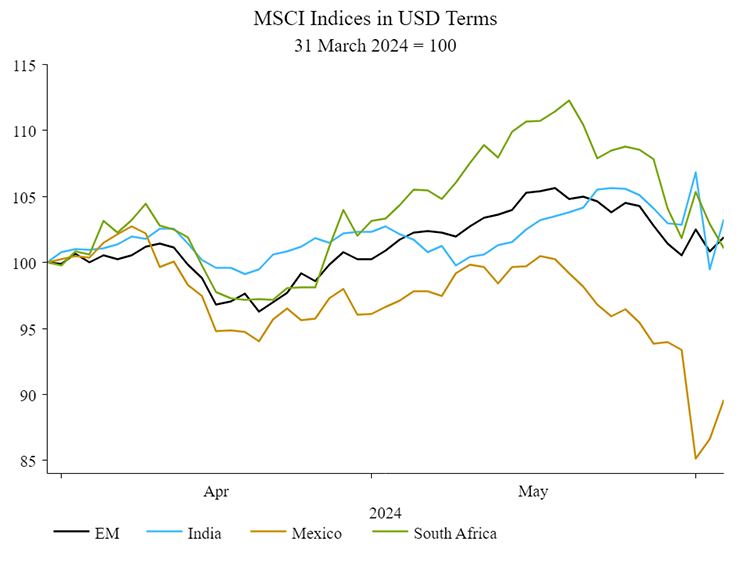

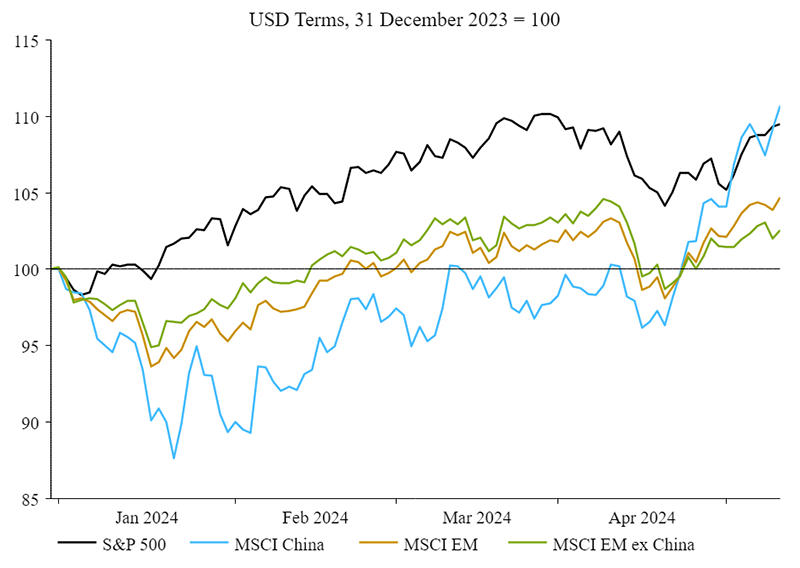

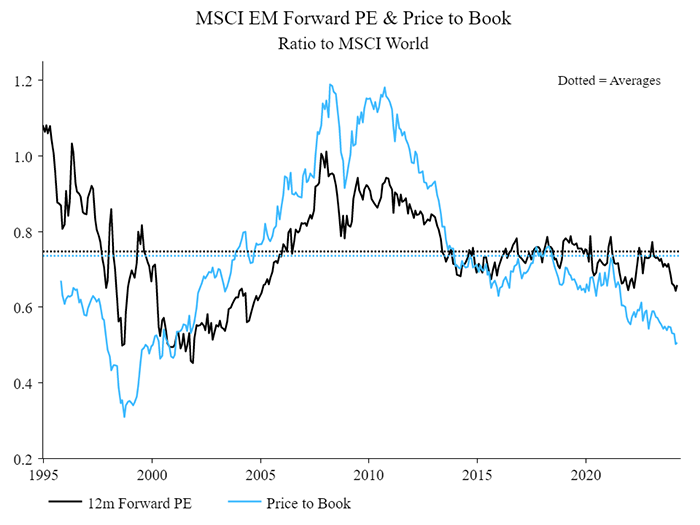

The underperformance of emerging markets equities relative to the US has tested the patience of even its most diehard advocates of the asset class over the past few years. While EM equities posted a respectable 9.9% return in USD terms in 2023, this looks anaemic next to a roaring 26.3% for the S&P 500.

The disparity between the US and EM over the past decade tempts investors into the behavioural trap of building conviction for future returns based on what has performed well in the recent past. It is easy to forget that the annualised returns from 2000 to end-2023 for EM were 7.6% versus 7.8% for the US, both outpacing 6.2% for MSCI World. The risk here is that a pro-cyclical mindset can lead to perverse thinking where conviction strengthens for a popular asset class as the likelihood of a good result decreases, and vice versa.

US equities outperformed on a decade of stronger economic growth out of the GFC, fed by a new credit cycle and strong fiscal deficits fuelling stronger corporate earnings and a dollar bull market, along with multiple expansion. On the flipside, EM moved through a painful deleveraging compounded by foreign reserve managers chasing US exceptionalism and buying dollars which choked EM further.

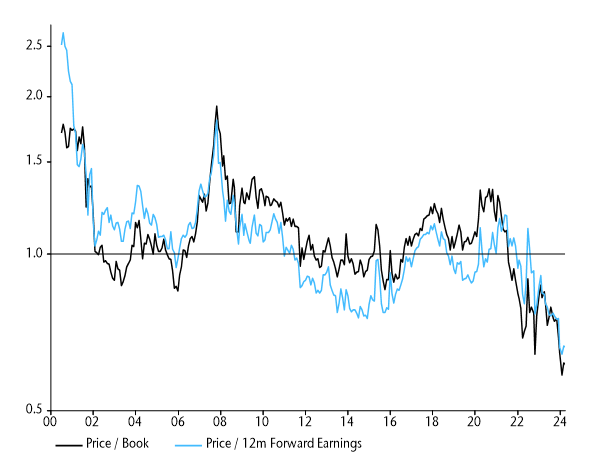

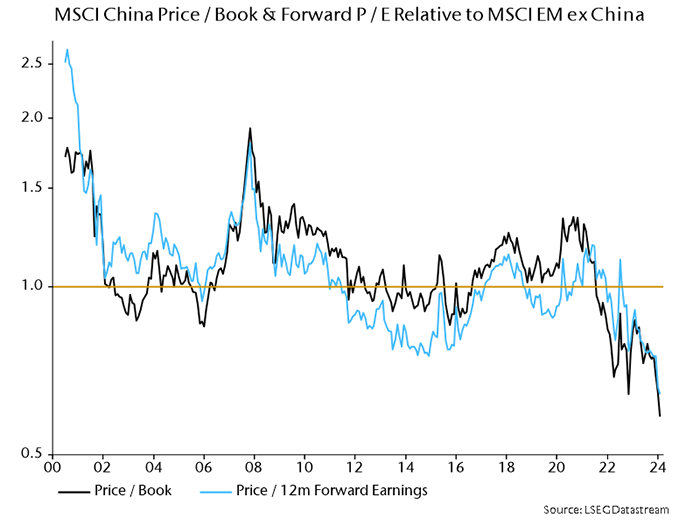

Several contrarian market commentators have recently pointed out that the fundamental picture in EM in many ways looks more compelling than in the US – lower valuations, trough earnings, cheap currencies, lower inflation, as well as greater fiscal and monetary discipline.

So what explains the continued underperformance, and is there anything that can break this cycle?

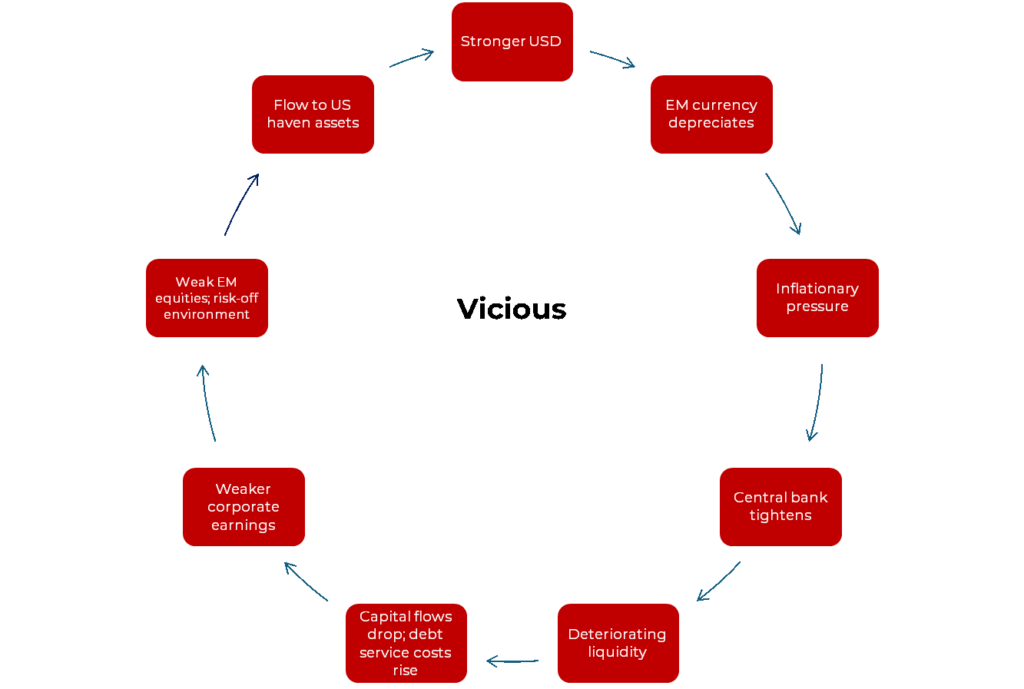

Vicious and virtuous circles in EM equities

George Soros’s theory of Reflexivity provides an explanation for how biases and preconceptions interacting with economic reality can distort market pricing and create extended periods of disequilibrium. For EM, the combination of weaker fundamentals coupled with a perception of US exceptionalism has led to the formation of a self-reinforcing feedback loop which has been a major headwind for the asset class. Below is a rough schematic for how this loop has played out.

Source: NS Partners.

Source: NS Partners.

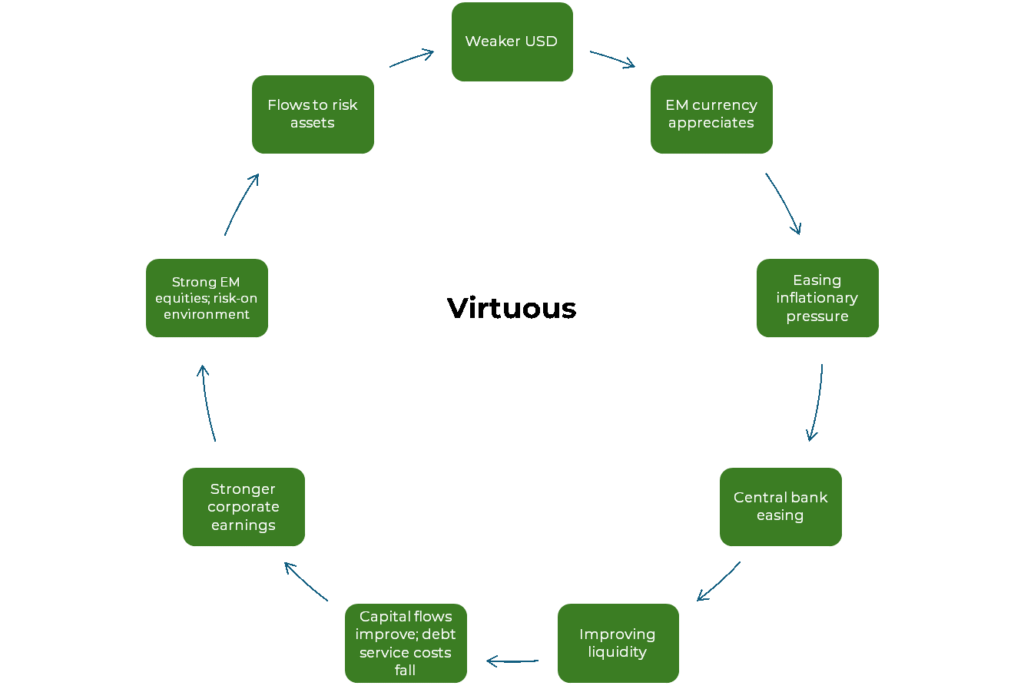

Our view is that this cycle is coming to an end. Indeed, we believe that there is potential for a shift into a “virtuous circle” for EM, outlined below.

Source: NS Partners.

Source: NS Partners.

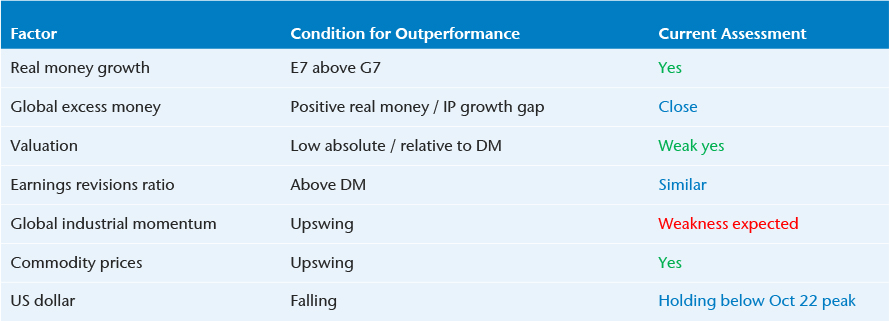

This outlook is based on a set of signals which we have used to advise clients invested in our DM and EM strategies looking to tweak the balance of exposure between the two. For context, our checklist is based on the idea that EM equities are a cyclical asset class and so tend to outperform when the global economy is strengthening (industrial cycle, commodity prices) and there is liquidity to chase the EM story (excess money, falling USD). They should also do better when economic prospects and earnings momentum are stronger than in DM (real money growth gap, revisions gap) and valuations are attractive.

Our latest update to the checklist (as of June 30, 2024) is below.

EM versus DM checklist

Source: NS Partners.

Source: NS Partners.

The balance of factors we monitor now favours emerging market equities for the first time in years.

Our two cents – don’t wait around until everything goes green, as you will have missed the sharpest part of the rally.

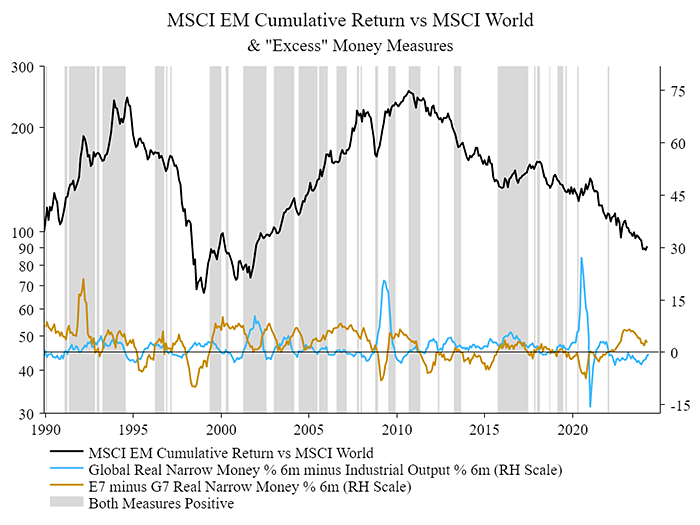

Two checklist factors deserve special attention, given their historical usefulness in signalling an improving environment for EM equities.

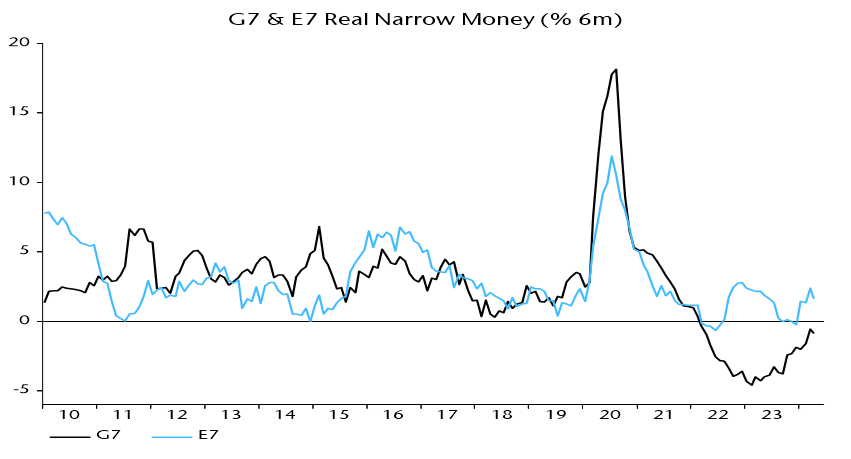

Liquidity

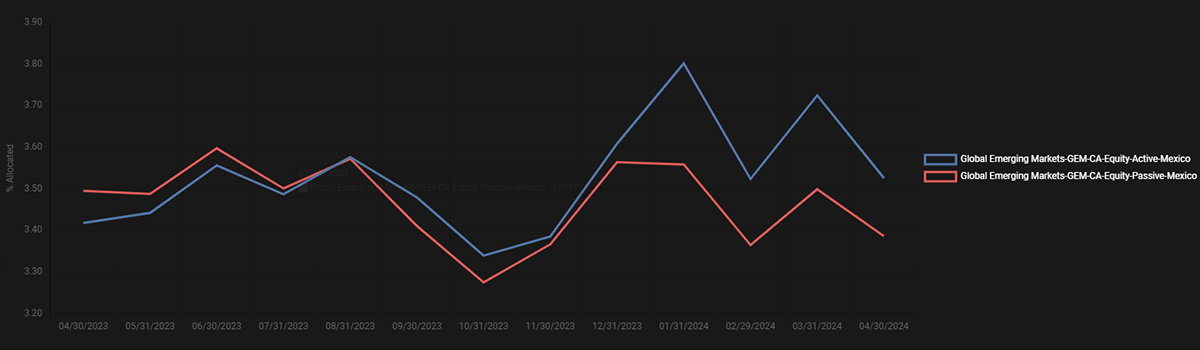

The E7 / G7 real money growth gap has been in favour of EM for some time, underpinned by better monetary policy making since 2020. This was reflected in better relative inflation performance for EM over DM, which has meant less need to tighten aggressively through the inflationary upswing, and potentially plenty of room to cut as the Fed eases.

Positive E7-G7 real money growth gap

Source: NS Partners and LSEG Datastream.

Source: NS Partners and LSEG Datastream.

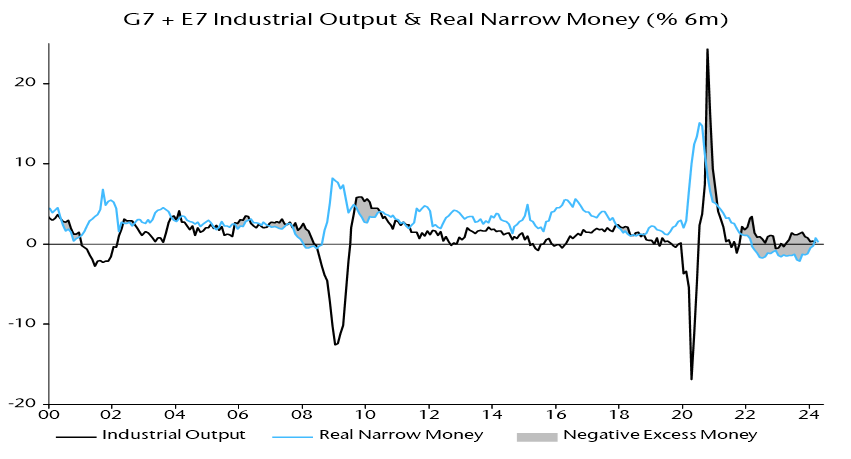

Additionally, the global excess money backdrop – proxied by the gap between real money and industrial output growth – may now be entering positive territory because of inflation peaking and industrial momentum weakening. The surplus liquidity can find its way into unloved financial assets, including EM equities. Prospective central bank pauses / reversals will sustain the trend.

Global “excess” money turning positive?

Source: NS Partners and LSEG Datastream.

Source: NS Partners and LSEG Datastream.

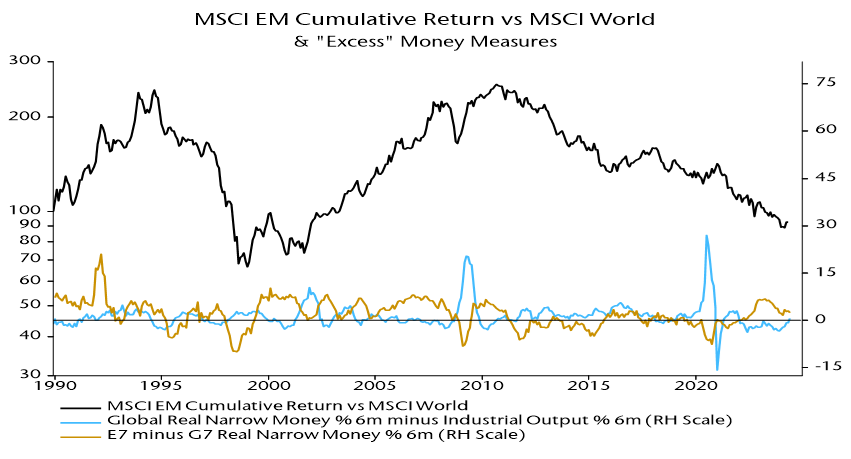

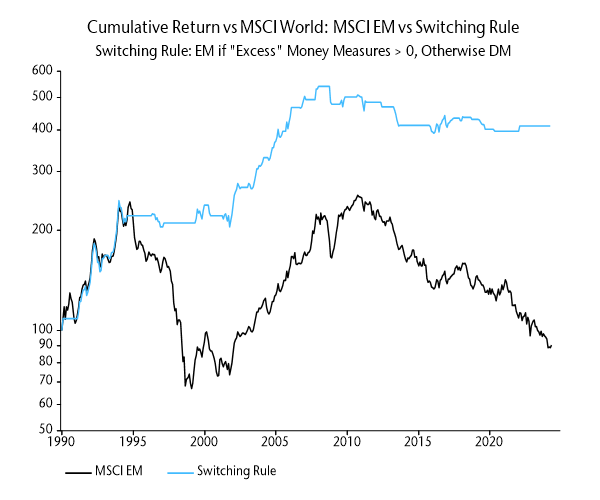

This is what we call a “double positive” liquidity environment, and could signal improving prospects for EM equities. In periods where these two monetary indicators have lined up this way, EM equities have outperformed MSCI World by an average of 10.5% per annum. Periods of EM outperformance are indicated in the shaded areas of the chart below. They line up nicely with the double positive.

EM relative performance & monetary indicators

Source: NS Partners and LSEG Datastream.

Source: NS Partners and LSEG Datastream.

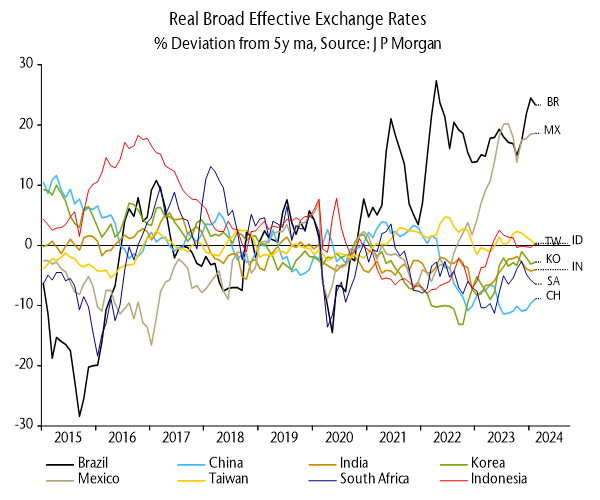

King Dollar

The vicious and virtuous cycle diagrams above hint at just how important the dollar is as a driver of price and fundamental momentum in emerging markets.

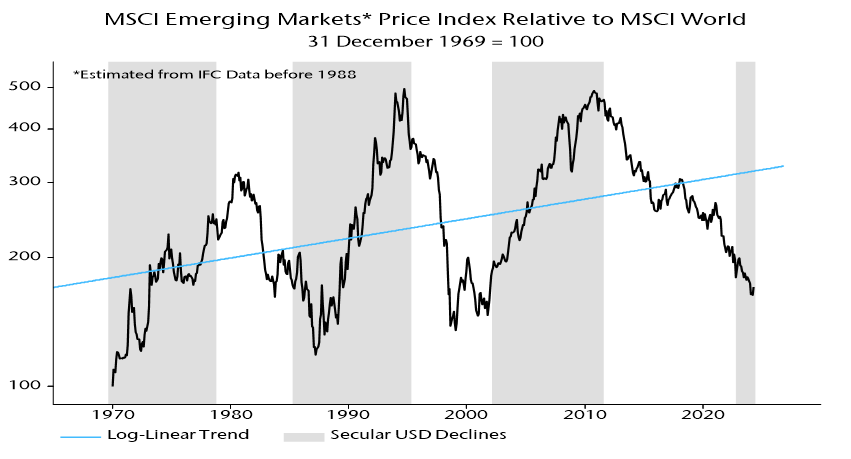

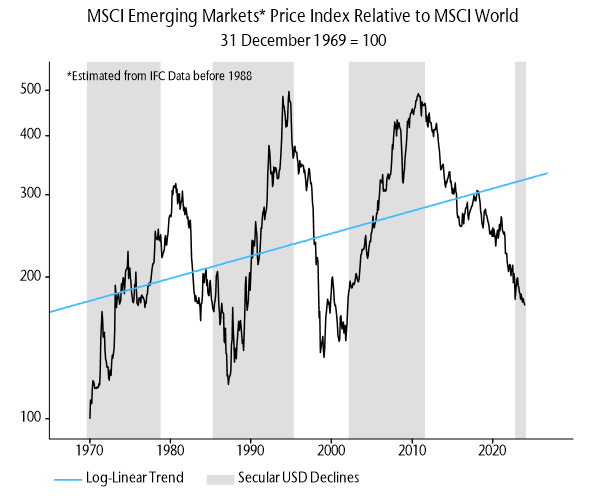

The chart below illustrates just how large a tailwind or headwind the dollar can be for the asset class.

EM outperformance during secular USD declines

Source: NS Partners and LSEG Datastream.

Source: NS Partners and LSEG Datastream.

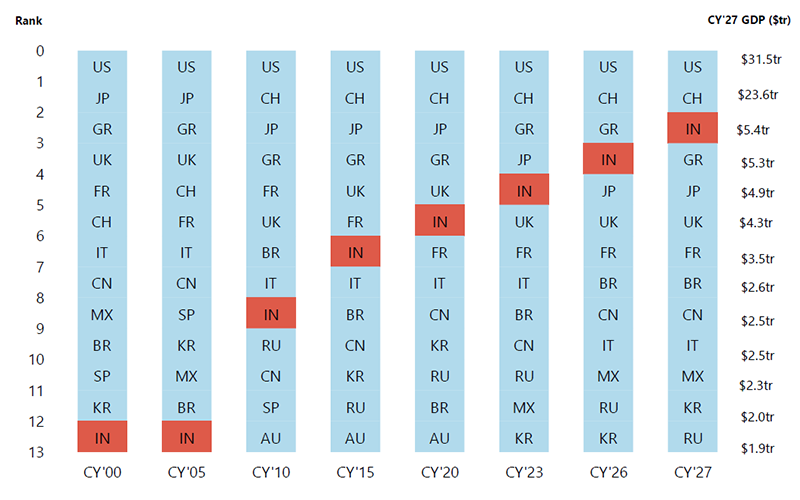

The relative performance drawdown for EM versus global equities during the last dollar bull market is in line with previous dollar bull markets, but the period over which this has occurred is roughly twice as long. The risk for investors fatigued from such an extended period of relative underperformance is capitulation right as the asset class is primed to outperform.

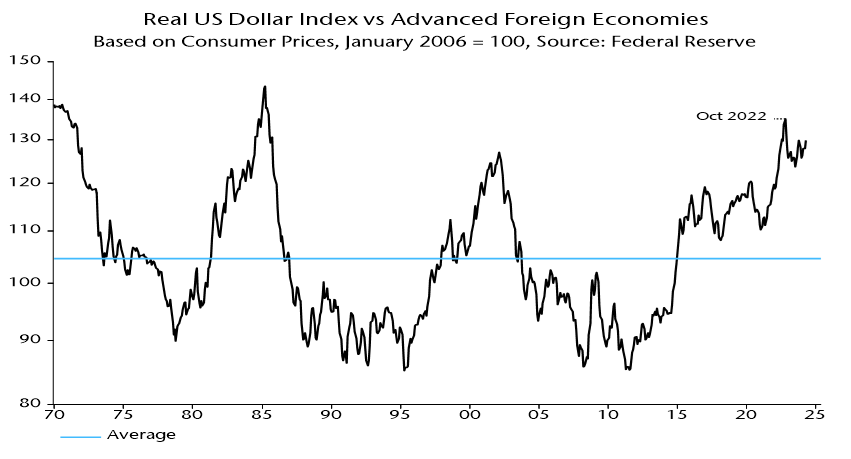

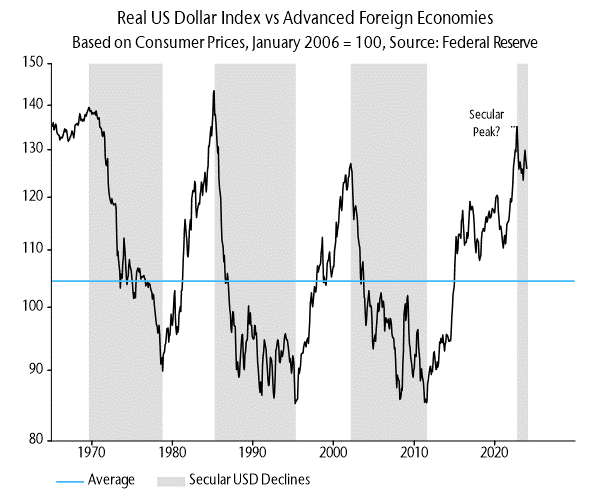

The real trade-weighted dollar is far above its long-run average and may have reached another secular peak in October 2022 – recent strength has failed to take out this high.

October 2022 USD peak?

Source: NS Partners and LSEG Datastream.

Source: NS Partners and LSEG Datastream.

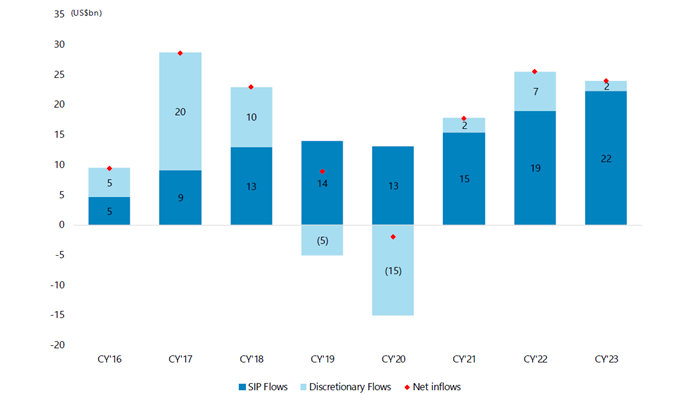

The combination of monetary easing as inflation falls coupled with a weaker US dollar would provide a favourable backdrop for the outperformance of EM equities. Likely easing by the US Federal Reserve later this year will provide further scope for emerging market central banks to cut rates, allowing the credit cycle to move from stabilisation/recovery into expansion, providing support to economic and corporate earnings growth.

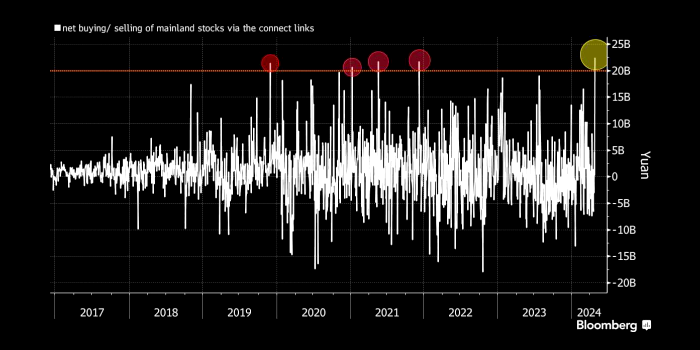

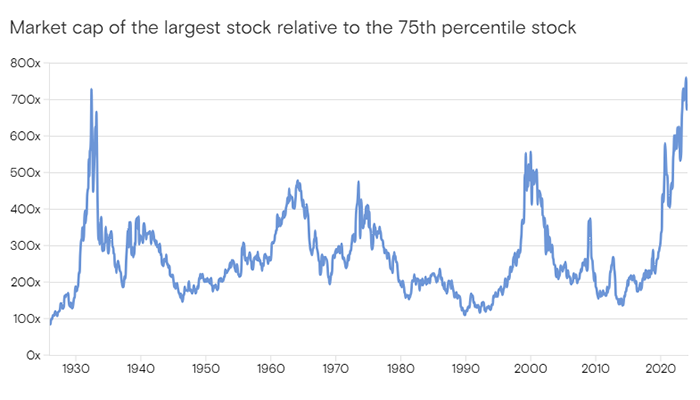

Such a pick up would encourage allocators oversaturated with US exposure to send marginal flows to emerging markets. With positioning at such extreme relative lows, even a small shift would be significant and another potential catalyst for entry into a virtuous cycle.

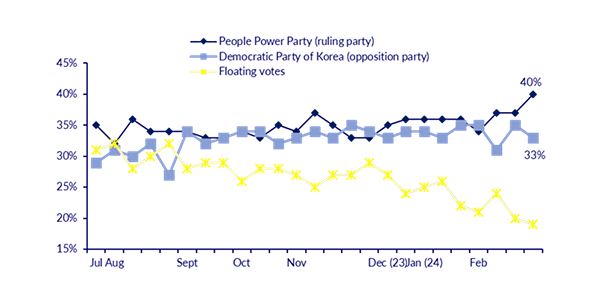

Source: Gallup Korea & CLSA, March 2024.

Source: Gallup Korea & CLSA, March 2024.

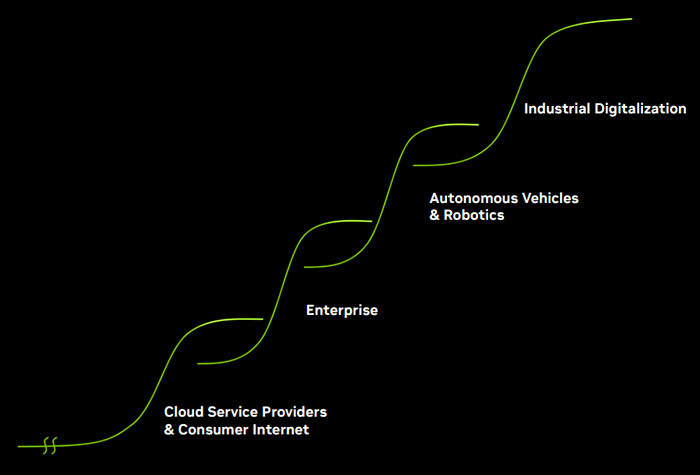

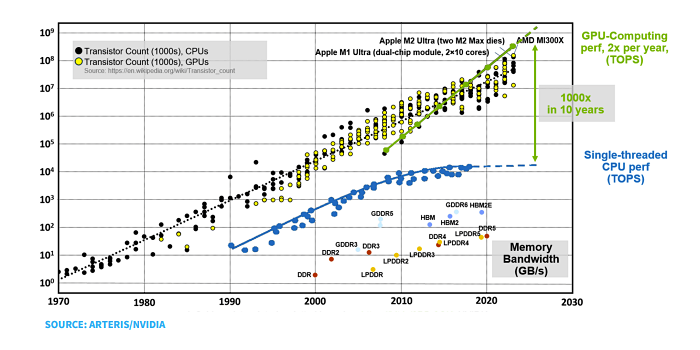

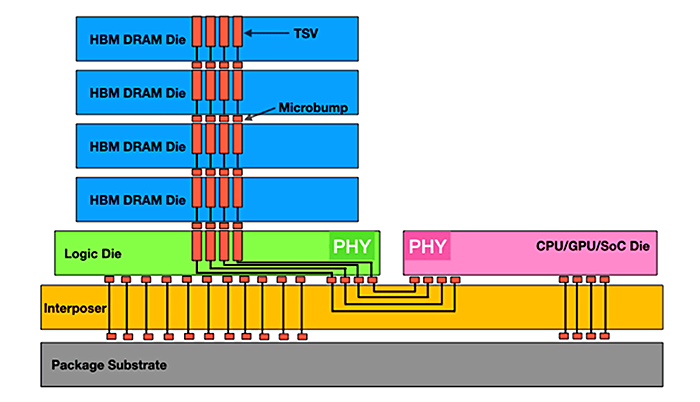

Source: Nvidia/Arteris, 2023.

Source: Nvidia/Arteris, 2023.  Source: Semiconductor Engineering, 2023.

Source: Semiconductor Engineering, 2023.

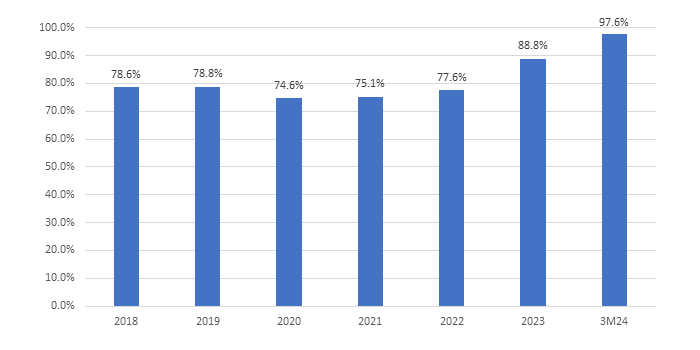

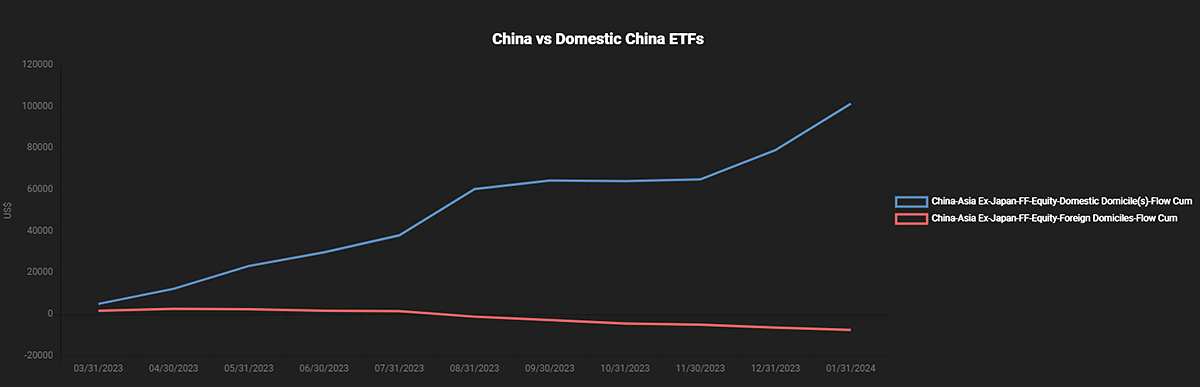

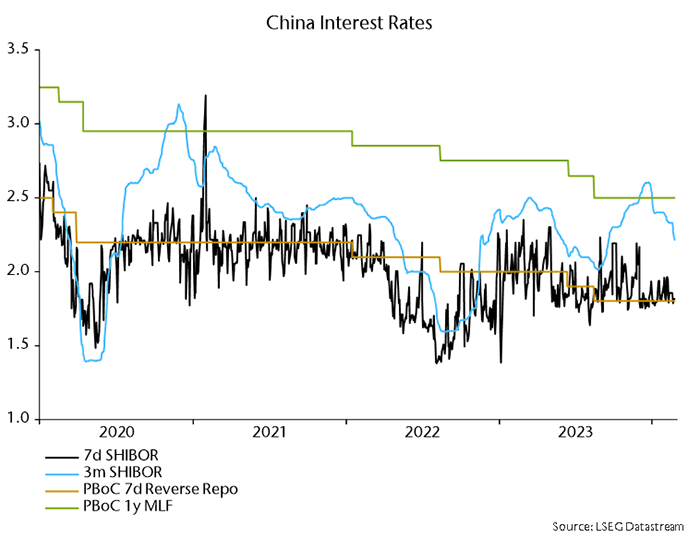

Source: LSEG Datastream.

Source: LSEG Datastream. Source: LSEG Datastream.

Source: LSEG Datastream.