Money Moves Markets

UK MPC policy pivot approaching as labour market cracks

May 17, 2023 by Simon Ward

Commentators have expressed scepticism about a large monthly fall in the “experimental” PAYE employees measure in April (136,000 or 0.45%, equivalent to a 700,000 drop in US non-farm payrolls).

It is true that initial estimates are often revised significantly but the largest upward adjustment to the month-on-month change historically was 121,000, relating to a pandemic-distorted month (March 2021*). The mean absolute revision over the last year was 34,000.

The recent trend, moreover, has been for downgrades – the initially estimated month-on-month change has been revised lower for five of the last six months.

The reported fall is consistent with the latest KPMG / REC Report on Jobs: the permanent placements index in April was the lowest since the start of 2021 and the PAYE measure last declined in February 2021 (based on current vintage data).

The regional breakdown of the PAYE measure shows falls in all 12 regions, with the largest (1.0%) in London – also consistent with the Report on Jobs, which reported that permanent placements weakness was led by London.

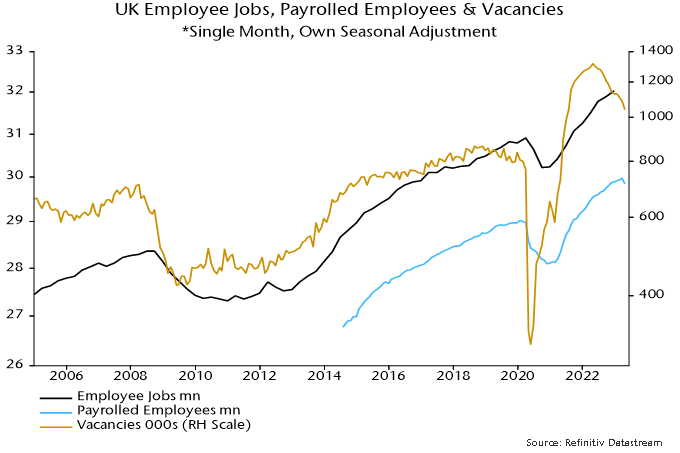

As the chart shows, the PAYE employees measure correlates with the quarterly employee jobs series, which has “official” status but is less timely – an end-Q1 number will be released next month. (This series, like US payrolls, counts positions rather than people.)

The Labour Force Survey employment measure rose by 182,000 in the three months to March from the previous three months but self-employment and part-time employees accounted for the increase – the number of full-time employees fell.

A post last week suggested that employment would begin a sustained decline in Q2, based on recent weakness in vacancies. The official vacancies series – a three-month moving average – fell again in April. The single-month number calculated here is now down 20% from peak (April 2022), with the month-on-month decline accelerating last month. (The FT incorrectly reported that vacancies stabilised in April.)

Another labour market report is due before the MPC’s next meeting on 22 June. Confirmation that employment is on a falling trend would transform the policy debate.

*The revision to the month-on-month change reflected a downgrade to the level of employment in February, not an upgrade to March.