Money Moves Markets

Stockbuilding data add to recession concerns

June 8, 2022 by Simon Ward

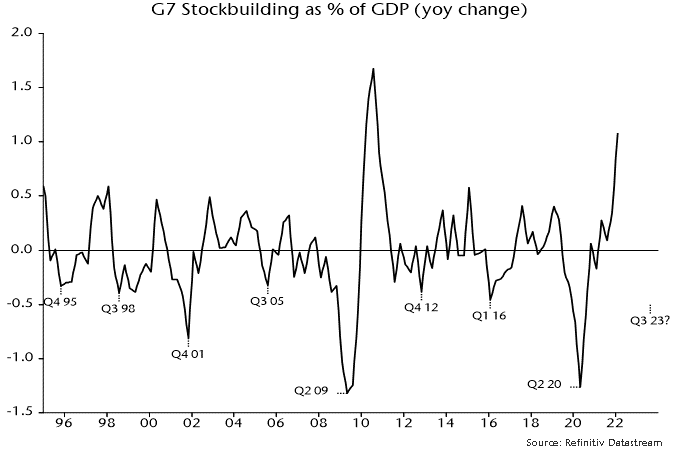

G7 GDP data confirm that stockbuilding gave an unusually large boost to growth in the year to Q1. Stockbuilding is almost certain to fall over coming quarters, implying that the growth impact will turn from positive to (probably large) negative. Prospective weakness in stockbuilding reinforces the recessionary signal from real money contraction.

Japanese and Eurozone GDP details released today showed “surprisingly” large increases in inventories in Q1, mirroring similar surges in the US, UK and Canada. For the G7 group, stockbuilding is estimated here to have reached 1.0% of GDP (real data).

GDP growth is related to the change in stockbuilding. G7 stockbuilding was negative in Q1 2021 – inventories fell by 0.1% of GDP. So stockbuilding as a share of GDP rose by 1.1 percentage points in the year to Q1 2022, i.e. stockbuilding “accounted for” 1.1 pp of GDP growth in the year to Q1 – see chart 1.

Chart 1

Q: Why is stockbuilding almost certain to fall from its Q1 level?

A: Because its estimated 1.0% share of GDP in Q1 is a record in data extending back to the 1960s, matched only in Q2 1974 (which immediately preceded a severe recession).

Its average share over 1965-2019 was 0.2%. If the actual share were to fall to this level in Q1 2023, the contribution of stockbuilding to annual GDP growth would be -0.8 pp in that quarter, representing a huge -1.9 pp swing from Q1 2022.

The annual change in G7 stockbuilding as a share of GDP is used here to date lows in the stockbuilding cycle. The cycle has averaged 3 1/3 years historically and the last low was in Q2 2020, suggesting another trough in H2 2023.

The extreme Q1 reading is consistent with a cycle peak but there is a chance that the annual change in the stockbuilding share will rise even further in Q2, reflecting a positive base effect – inventories fell by 0.4% of GDP in Q2 2021.

The argument that the stockbuilding cycle is about to become a major drag on global growth does not, it should be emphasised, rely on a forecast that firms will reduce inventories from their current level, only that the rate of accumulation will slow. Stockbuilding is often still positive at cycle lows.

Following such extreme accumulation, however, a liquidation of inventories is certainly possible and would, of course, reinforce recessionary dynamics.