Money Moves Markets

Global weakness tempered by EM resilience

June 7, 2023 by Simon Ward

Monetary trends continue to give a negative message for global economic prospects, suggesting that European / US weakness will outweigh resilience in major EM economies.

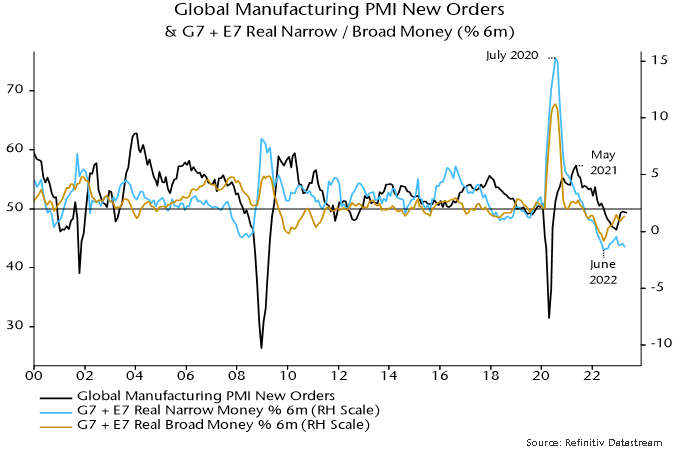

G7 plus E7 six-month real narrow money momentum fell again in April, extending a move down from a local peak in December and suggesting a decline in economic momentum through late 2023 – see chart 1.

Chart 1

A revival in real narrow money momentum in H2 2022 was reflected in a recovery in global manufacturing PMI new orders between December and March. The recovery stalled in April / May and the forecast here remains for a relapse and possible retest of the December 2022 low during H2 2023.

Narrow money has outperformed broad money as a leading indicator historically, in terms of reliability in signalling turning points in economic momentum. Narrow money usually weakens relative to broad money when interest rates rise as depositors are incentivised to shift funds to less liquid accounts. This is an important feature of the transmission mechanism and one of the reasons narrow money outperforms as a forecasting indicator.

An argument, however, has been made that the unusual speed of the rise in interest rates over the past year, coupled with worries about deposit safety following recent bank failures and an associated switch into money market funds, may have exaggerated narrow money weakness relative to “true” economic prospects. This would suggest giving greater weight to broad money trends at present.

As chart 1 shows, global six-month real broad money momentum recovered more strongly during H2 2002 and has stalled rather than fallen back since December. Still, the message for economic prospects is weak, suggesting no growth revival before 2024.

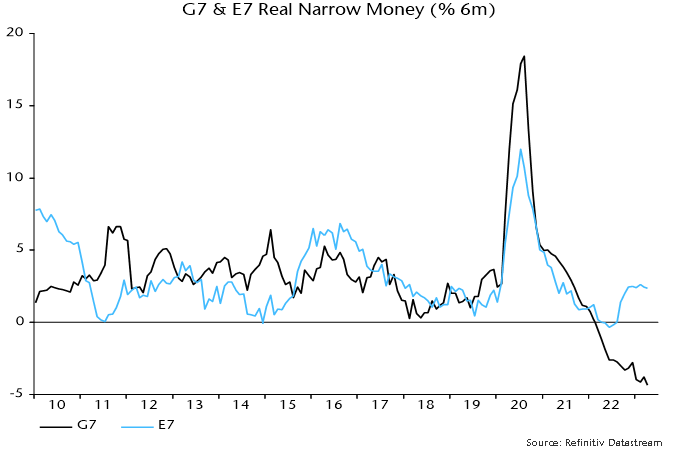

A marginal decline in global manufacturing PMI new orders in May reflected a notable weakening of the DM component offset by stronger EM results. EM resilience is consistent with recent stronger E7 real money momentum (broad as well as narrow) – chart 2.

Chart 2

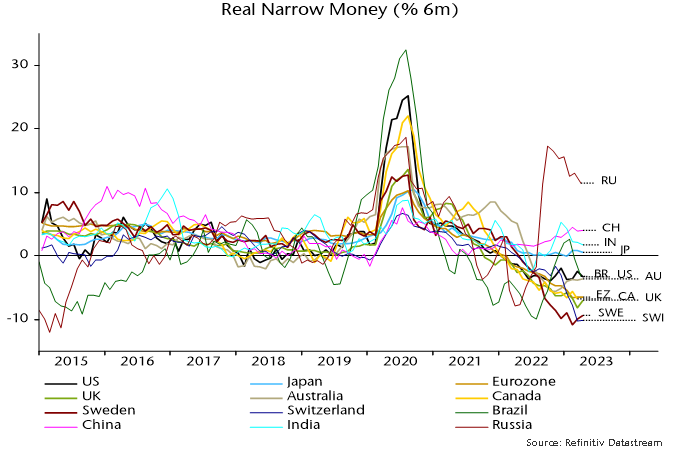

Charts 3 and 4 show six-month real narrow money momentum and manufacturing PMIs in selected major economies. Russia, China and India top the real money momentum ranking with weakness focused on Europe – particularly Switzerland and Sweden. The latest PMI results mirror the real money ranking (rank correlation coefficient = 0.85), with recessionary readings in the Eurozone, Switzerland and Sweden contrasting with Indian / Russian strength.

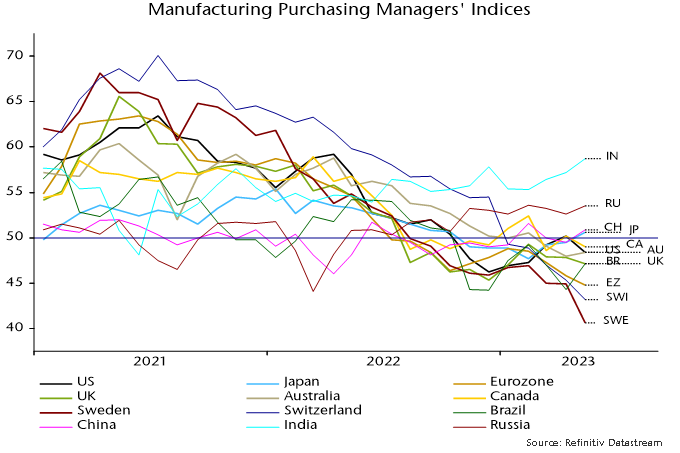

Chart 3

Chart 4