L’argent, le moteur des marchés

Chinese money update: recovery on track but further easing needed

15 juillet 2022 par Simon Ward

Chinese monetary data for June confirm that policy easing is gaining traction but narrow money growth remains modest compared with previous reflationary episodes and a H2 economic recovery is likely to be dampened by weaker exports.

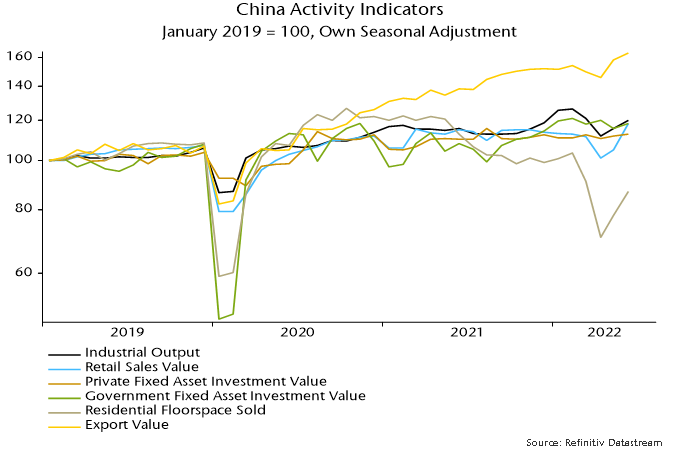

GDP fell by 2.6% between Q1 and Q2 but monthly activity data indicate a significant recovery from an April trough, with June exports and retail sales particularly strong – see chart 1.

Chart 1

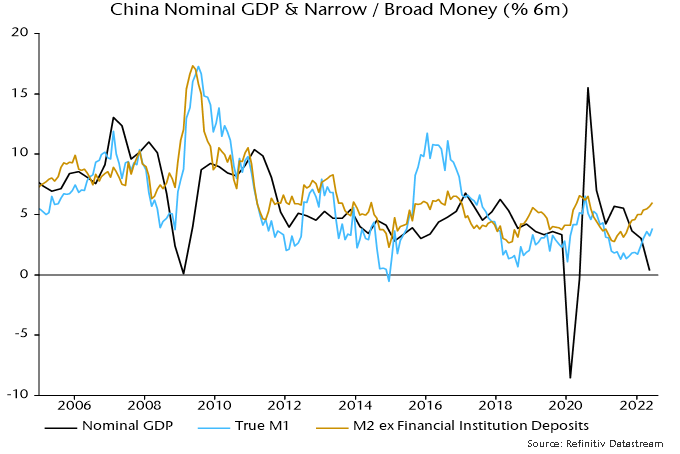

Six-month growth rates of narrow and broad money, meanwhile, rose further in June, to 17- and 22-month highs respectively – chart 2.

Chart 2

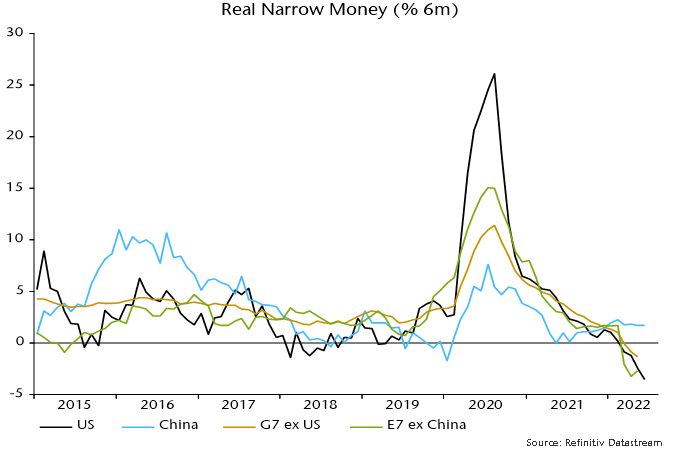

Six-month growth of real narrow money has moved sideways, with faster nominal expansion matched by a rise in consumer price momentum. Nevertheless, positive and stable real money growth compares favourably with deepening contractions in the US, Europe and many emerging economies – chart 3.

Chart 3

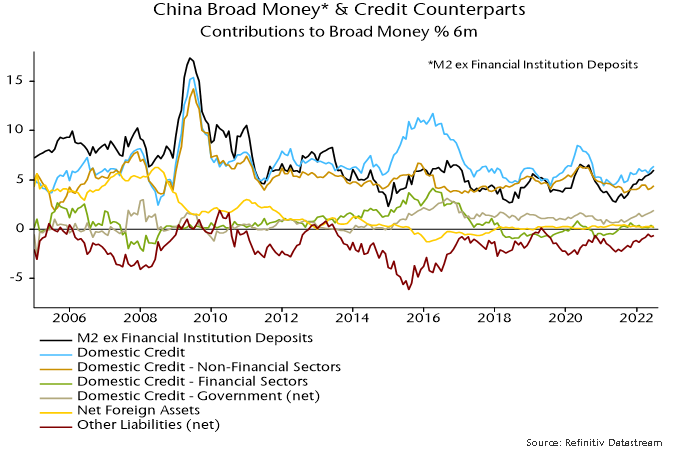

What is driving faster money growth? The credit counterparts analysis of broad money shows major contributions from banks’ net lending to government, reflecting expansionary fiscal policy, and from unspecified items within non-monetary net liabilities. Growth of bank lending to other sectors bottomed last year but has yet to establish a rising trend – chart 4.

Chart 4

Six-month growth of broad money is close to levels reached in previous successful reflationary episodes since the GFC but narrow money growth remains well below the corresponding highs – chart 2. The judgement here is to place more weight on the less upbeat message from narrow money. The demand for broad money may have been boosted by risk aversion due to housing and equity market weakness, as well as the pandemic. Domestic credit expansion, like narrow money growth, is below previous reflationary highs – chart 4.